We at Investcorpus identify the loop holes and plug in those underlying gaps with 360 degree personalized financial solution to suit your current and future personal finance management which addresses the wealth creation with the blend of provisions for any unprecedented and unforeseen circumstances ahead in our lives ranging from mutual fund to build long term wealth for our loved ones to our own golden ages of retirement with a perfect happening and fulfilling life with care and respect!!

We at INVEST CORPUS sails you through road blocks in personal financial planning which includes retirement planning ( fear of living long), general insurance , life insurance ( to protect against the uncertain and harsh events in life ) , mutual funds ( to build wealth for different life goals ) , personal credit facility against equity shares and mutual funds ( to meet unprecedented expenses in life without liquidating your equity holdings )

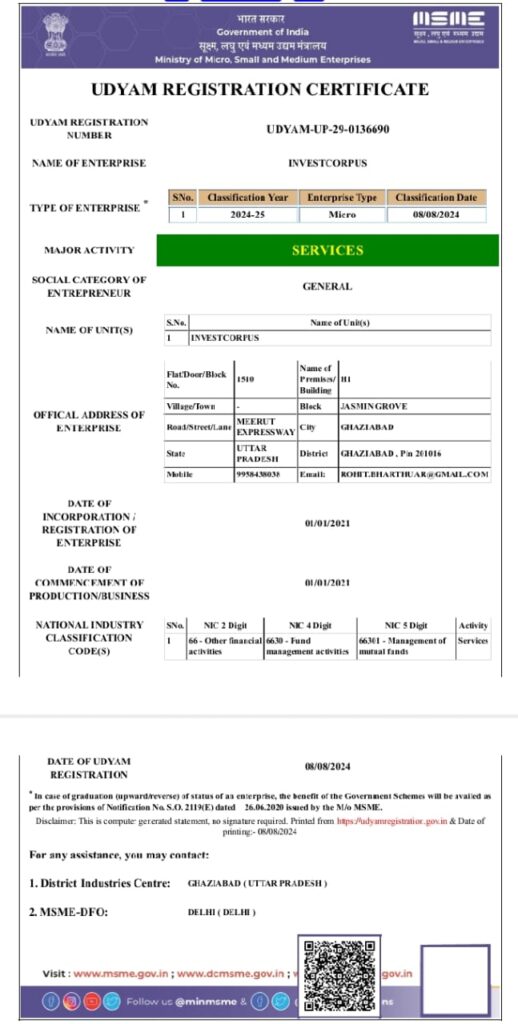

Who We Are?

We serve as a Financial Planners. We support our clients in setting financial objectives, producing, protecting, and managing wealth through the development of strategic investment programs, and achieving success in wealth management. Our clients’ investment strategies and distinctive, personalized wealth management approaches significantly improve, empowering them to make wise financial and investment decisions.

What makes us unique?

Our clients benefit from objective, real financial guidance because to our need-based and principle-centered wealth management approach. We talk about debunking myths and answering our clients’ questions more with them. The clients’ degree of awareness regarding financial planning will rise as a result.

How we can help you?

- Achieve personal financial planning goals by creating, preserving, and managing long-term wealth.

- Make smarter financial decisions overall, reduce costs, control risk, and free up time.

-

To safeguard your assets, your family, and yourself, decide what kind and quantity of insurance you require.

- The goal is to help individuals navigate the complex world of retirement options and achieve the retirement they have always desired.

- Enhance the efficiency of asset transfer to loved ones in the event of misshaping/death.