Mutual Fund

Mutual Fund allows specified investment goals, such as growth or income

Avail Mutual fund from leading AMC in India –

- Franklin Tempelton Mutual Fund

- Motilal Oswal Mutual Fund

- Kotak Mutual Fund

- Aditya Birla Sun Life Mutual Fund

- ICICI Prudential Mutual Fund

- Quant Mutual Fund

- SBI Mutual Fund

- Axis Mutual Fund

- Invesco Mutual Fund

- HDFC Mutual Fund

- Samco Mutual Fund

- PPFAS Mutual Fund

- Edelweiss Mutual Fund

- DSP Mutual Fund

- Mirae Asset Mutual Fund

- Canara Robecco Mutual Fund

- Union Mutual Fund

- UTI Mutual Fund

- JM Financial Mutual Fund

- Nippon India Mutual Fund

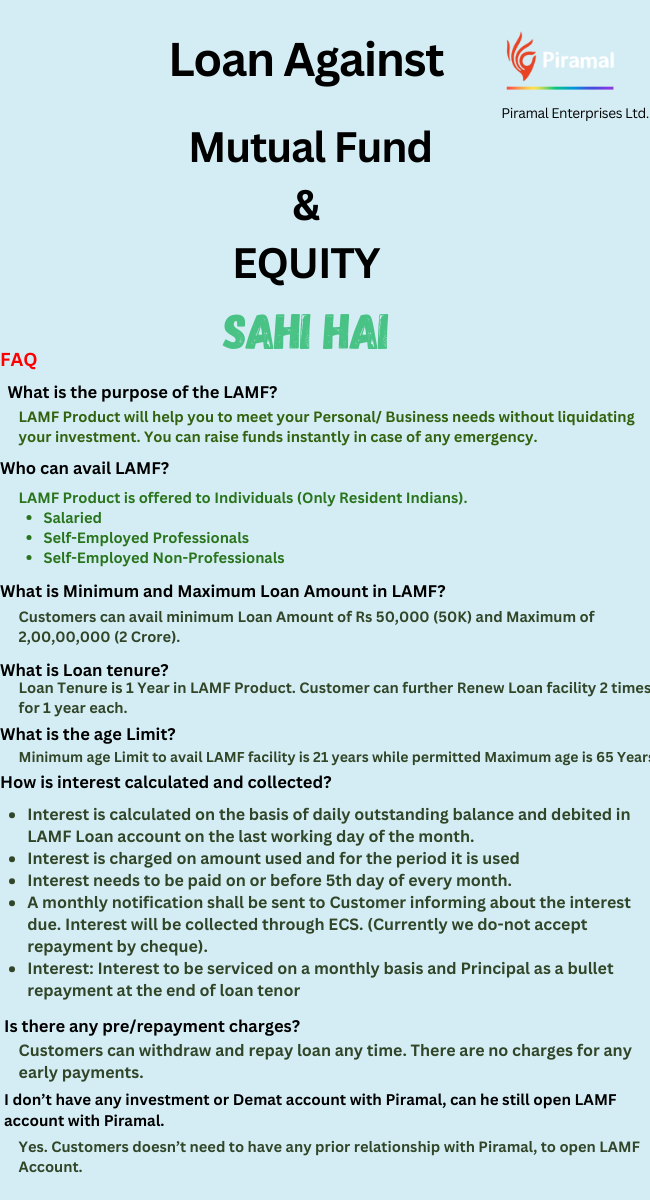

Get Loan Against Mutual Fund with Piramal Enterprises Ltd.

We provide Loan against Pledge of Mutual Funds & Equity/Stock

It is a Flexi Loan – Disbursement in one or more tranche(s) which enables customers to withdraw money as per their requirement. Interest is charged only on utilized amount for the period of utilization. You can easily access cash up to Rs. 2 crore , & earn (CAGR) on your holdings.

Benefits of Product:

- Loan at your Doorstep

- Hassle Free process

- Minimal Processing Fees and No Foreclosure Charges.

- Wide Range of collateral, Higher LTVs against debt funds.

Apply Loan Now : https://investcorpus.in/contact-us

Loan Against Equity/Stock

The benefits of a loan against equity/stock are many, and it can be a great way to get quick access to cash.

Benefits of Loan Against Equity/Stock with Piramal Enterprises Ltd.

- The loan can be used for any purpose.

- The interest rate on a loan secured by shares is typically lower than that of other loan kinds.

- The loan can be used in any way you choose.

- The loan is simple to apply for.

- It’s quick to have the loan approved.

- Collateral for further loans may be obtained using the loan.

- Repayment of the debt can take longer.

- You are able to deduct interest from your taxes related to the loan.

- One may use the loan to invest in a business or purchase shares.

- A loan against several equities is available to you.

Apply Loan Now : https://investcorpus.in/contact-us

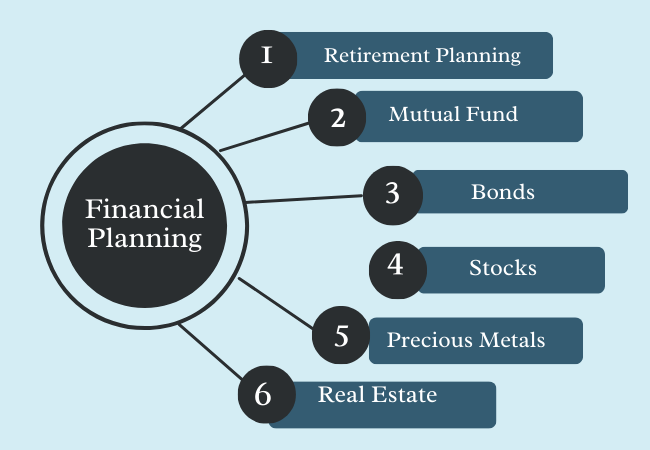

Financial Planning

Trustworthy and knowledgeable financial advising services by experts

Offer individualized advising services that are catered to your particular financial objectives, such as managing your wealth, investing for the future, or saving for retirement.

Benefits of Financial Advisory Services

- Managing Risk

- Mental tranquility

- Achieving the Goal

- Optimization of Investments

- Tax Effectiveness & more

Financial Advisory Service Types

- Financial Guidance Services.

- Tax Advisory Service.

- Retirement Planning Services.

- Risk Management Services & more

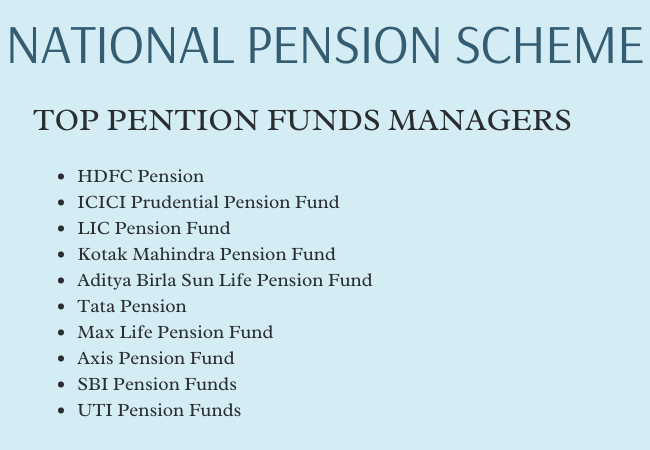

National Pension Scheme

For retirement life security & Tax benefits

NPS is pension system providing defined-contribution coverage for retirees and all citizens during retirement, premature exit, or death.

Advantages of NPS investments

- Retirement life security.

- Tax Benefit Under Tier I Account

- Higher Long-term profits returns of SIP in NPS

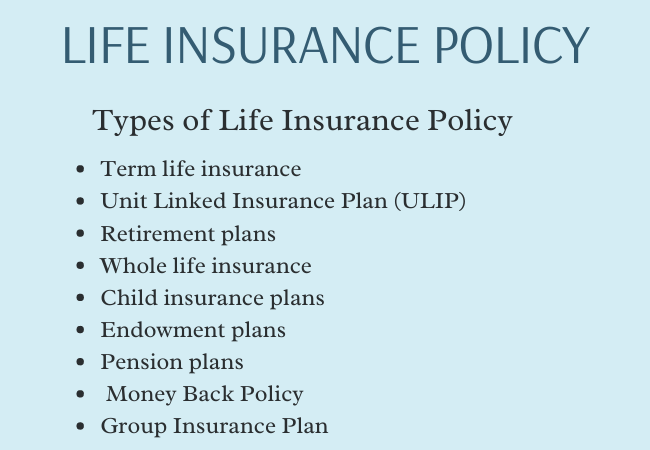

Life Insurance

Financial protection

Financial security for your love ones

Life insurance helps families meet financial demands after death, paying off debts and supporting future goals. Review finances before purchasing, choosing appropriate coverage from various types for financial security.

Benefits of life insurance:

- Life Coverage

- Tax Benefits*

- Flexible Premium payment options

- Same Day Claim Processing

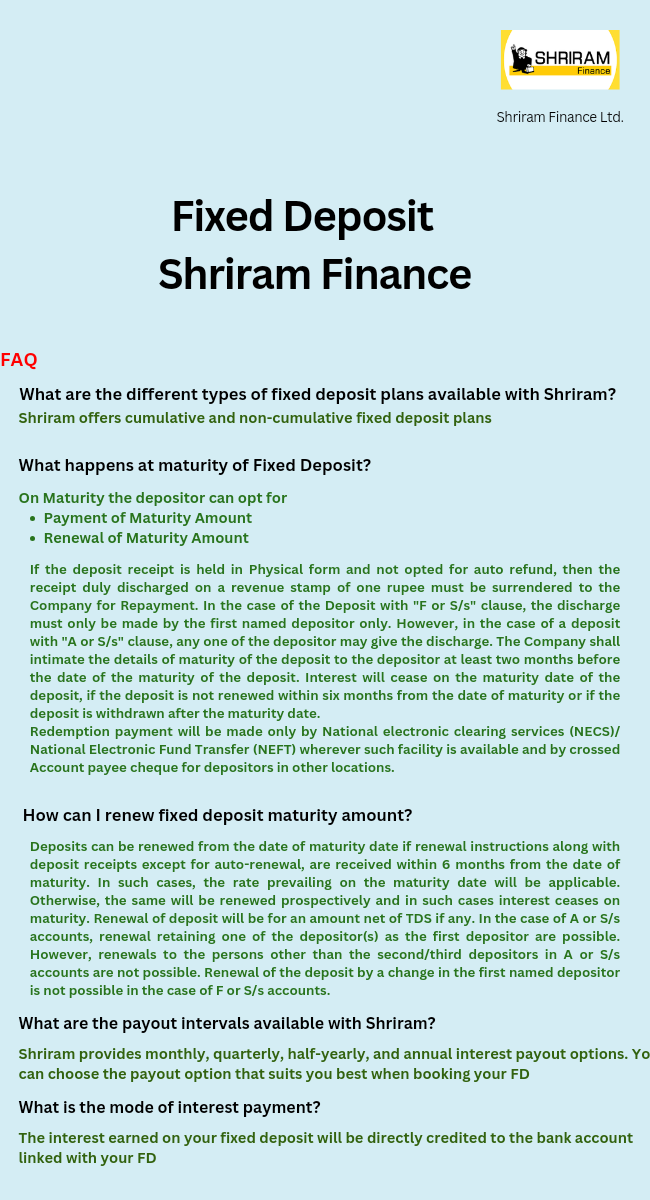

Fixed Deposit

A Fantastic Opportunity To Earn Up To 9.40% Each Year. T&C Apply.

Did you know that saving is the first step towards investing?

It is not ideal to let your hard-earned money sit idly in a bank account. Invest in a fixed deposit to get consistent savings, growth, and inflation-beating returns. The most secure investment alternatives available in India are still fixed deposits.

Features & Benefits of FD by Shriram Finance

- Higher Interest Rate (IR): As high as 9.40%* p.a.

- Benefits for Senior Citizens: Additional 0.50%* p.a.

- Special IR for Women: Additional 0.10%* p.a.

- Flexible Tenure: 12 to 60 months

- Flexible Payout Options: Payout before maturity.

- Guaranteed Returns: Even In Fluctuated market.