Our Partner

The national pension system was introduced by govt of India on 1 JAN 2004, Regulated by Pension Fund Regulatory and Development Authority. The main purpose of NPS is to provide a defined-contribution-based pension system for retirees and extend old age security coverage to all citizens of India at the time of retirement/premature exit/death by way of annuity and lump-sum withdrawal as per norms.

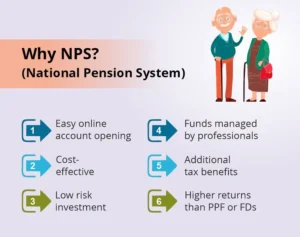

Advantages of NPS investments for post-retirement life security. Available tax benefit under Tier I Account: Employee Contribution: Special provision for tax savings: Tax deduction under Section 80CCD (1B) for a Rs. 50,000 contribution.

New subscriber onboarding link for NPS (for new subscribers)

Below link is for subsequent contribution in NPS (for existing subscribers)

By using Rupee Cost Averaging, an investor can reduce market volatility and outperform the market. SIP averages an investor’s savings by allocating more units during a period of extreme stock price decline and fewer units during periods of significant stock price growth.

Long-term profits from SIP returns are often higher than those from NPS returns. Due to the strength of compounding that SIP utilizes, if you start investing early in a diverse equities portfolio using the SIP route, you would be able to accumulate a comfortable corpus.

Investcorpus can help you to do SIP In NPS in one click below

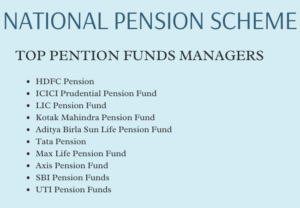

HDFC PENTION : Updated NPS Details Below

Your Personal Financial Planner

Latest Post

- India-Pakistan Tensions Escalate: Cross-Border Firing Continues as UN Security Council Holds Emergency Talks

- U.S. Visa Waiver Program: 41 Countries Eligible for 90-Day Visa-Free Travel

- India’s Zero-for-Zero Tariff Proposal: Strengthening Bilateral Trade with the U.S.

- India’s Economic Rise: Set to Overtake Japan in 2025, Poised to Become 3rd Largest Economy by 2028

- India-Pakistan Tensions: Moody’s Warns of Forex Pressure on Pakistan, Sees Minimal Economic Impact on India