FIXED DEPOSIT

An Amazing Opportunity To Earn Up To 9.40%* p.a. T&c* Apply

1.Overview 2.Features & Benefits 3.Apply 4.Interest Rates 5.Eligibility 6.FAQ ⇐ Click To View

Overview

Did you know that saving is the first step towards investing?

It is not ideal to let your hard-earned money sit idly in a bank account. Invest in a fixed deposit to get consistent savings, growth, and inflation-beating returns. The most secure investment alternatives available in India are still fixed deposits.

Features & Benefits

Higher Interest RateGrow your savings with interest rates as high as 9.40%* p.a. |

Benefits for Senior CitizensSenior citizens get an additional 0.50%* p.a. |

Special Interest Rates for WomenWomen depositors get an additional 0.10%* p.a. |

Flexible TenureChoose from the flexible investment options starting from 12 to 60 months |

Flexible Payout OptionsChoose from flexible interest payout options, i.e., monthly, quarterly, half-yearly, yearly or at maturity. |

Guaranteed ReturnsGet steady and assured returns irrespective of market fluctuations. |

Safe & Secure InvestmentRated “[ICRA]AA+ (Stable)” by ICRA and “IND AA+/Stable” by India Ratings and Research |

Optimal Investment, Maximum ReturnsStart your investment journey with a minimum deposit amount of ₹ 5000 |

Compounding BenefitsEarn compounded interest on the invested amount and multiply your money faster |

1.Overview 2.Features & Benefits 3.Apply 4.Interest Rates 5.Eligibility 6.FAQ ⇐ Click To View

Applying for Shriram Fixed Deposit online at Investcorpus is easy

Step 02: We will contact to complete your payment and KYC and bank details Online

Step 03: Get fixed deposit acknowledgement & maximize your returns

1.Overview 2.Features & Benefits 3.Apply 4.Interest Rates 5.Eligibility 6.FAQ ⇐ Click To View

Eligibility

Who can invest in a Fixed Deposit with us?

Resident

|

Partnership Firms |

Companies |

Hindu Undivided Families (HUFs) |

Trusts and Foundation |

NRIs (Accepted for a maximum period of 3 years) |

Unincorporated Association or Body of Individuals |

|

1.Overview 2.Features & Benefits 3.Apply 4.Interest Rates 5.Eligibility 6.FAQ ⇐ Click To View

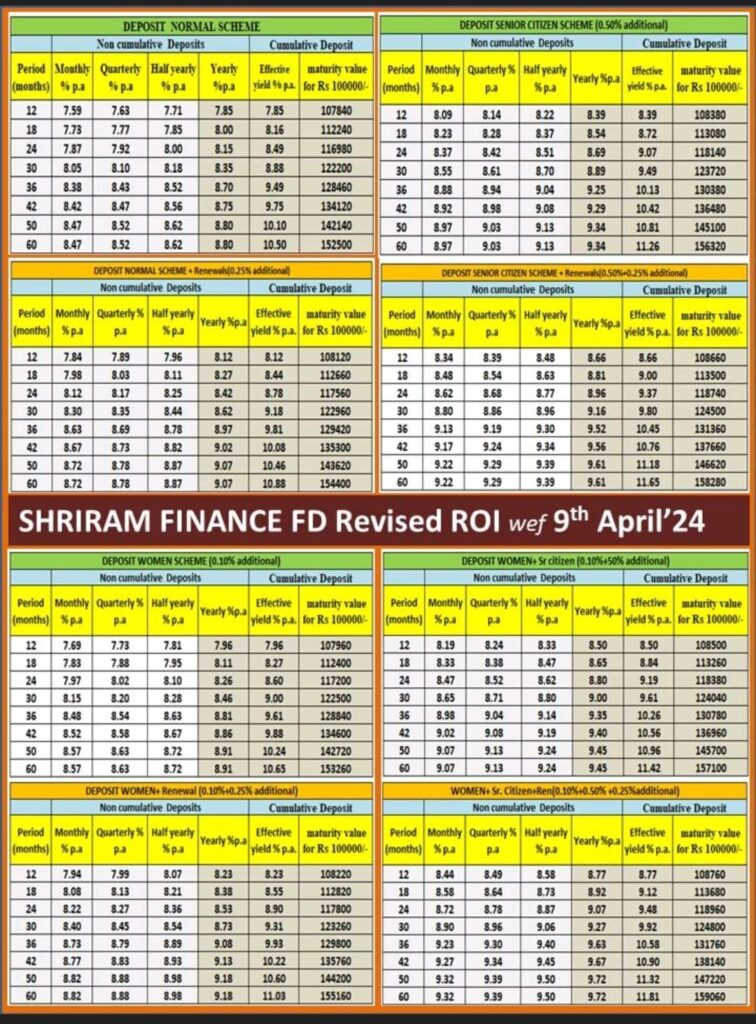

Interest Rates

An investment that is secure and unaffected by market swings is a fixed deposit. Check the fees and interest rates for Shriram Finance Fixed Deposits.

Interest Rates:

Interest rates up to 9.40%* p.a.

Including 0.50%* p.a. for Senior Citizen

and 0.10%* p.a. for Women

INTEREST RATES-ON FRESH DEPOSITS/RENEWALS ( w.e.f 9th April 2024)

1.Overview 2.Features & Benefits 3.Apply 4.Interest Rates 5.Eligibility 6.FAQ ⇐ Click To View

FAQ

Will the deposit be repaid in cash?

The deposit will only be transitioned to the corresponding bank account as updated in Shriram Finance’s records.

What happens if the common interest rates fall or rise?

There will be no adjustments to existing deposits because we are required to pay the negotiated rate until maturity under current rules.

The updated rates will only apply to new deposits and renewals placed on or after the date the new rates are effective.

What regulations govern fixed deposits accepted by NBFCs?

The Reserve Bank of India released the Non-Banking Financial Companies Acceptance of Public Deposits (Reserve Bank) Directions, 2016, which govern NBFCs’ public fixed deposit schemes.

What means a nomination?

Nomination is a process in which a depositor designates someone to whom the company must pay the deposit amount in the case of the depositor’s death. When scheduling an FD, a depositor has the option of providing nomination information.

What are Forms 15G and 15H, and where can I get them?

Form 15G/15H is a self-declaration by the depositor that can be received from the company or downloaded [15G (For Depositors Under 60 Years of Age). / 15H (For depositors aged 60 and above) It is a self-declaration that requires no authentication from anyone, with the exception of the Left Hand Thumb impression, which must be attested by a Gazetted Officer or Bank Official. It should be given in duplicate.

To submit your 15G/H form for your current investment with Shriram Finance, please log in to our customer portal or contact us.

When is income tax deducted at the source from interest?

If the expected annual interest paid/credited or likely to be paid/credited on the deposit/s exceeds or is likely to exceed 5,000 /- for the fiscal year (i.e. year 2022-23), the tax deductor is required to deduct income tax at source. To avoid such a tax deduction, investors can provide a self-declaration in Form 156/H or submit an exemption certificate from the appropriate Income Tax Authority for each fiscal year prior to the start of that fiscal year.

What form of certificate do you receive for the tax deducted at source, and how is it generated?

Tax deduction certificates in the prescribed Form 16A containing details of the tax remitted to the government, among other things, will be sent on a quarterly basis if the deposit is under the quarterly scheme, half-yearly for deposits under the half-yearly scheme, and at the end of the year for yearly and cumulative deposits.

TDS certificates in Form 16A are prepared quarterly using the information supplied in the quarterly TDS statement filed by the tax deductor in TIN (Tax Information Network).

For tax deduction at source, the company will generate a TDS certificate in Form 16A through the TIN central system, which may be obtained from the TIN website with a unique TDS certificate number and authenticated using a digital signature.

To acquire the TDS certificate for your existing investment with Shriram Finance, please login to our Customer Portal.

What distinguishes a cumulative deposit from a non-cumulative deposit?

The interest on a cumulative fixed deposit is compounded over the duration of the deposit and paid out at maturity. On the other hand, depending on the tenure selected, the interest amount in a non-cumulative FD is due monthly, quarterly, half-yearly, or annually. The periodicity of interest payments is where the two differ from one another.

I am NRI can i do a fixed deposit?

Yes. Fixed deposits from NRIs are accepted starting January 4, 2021 for three years, as Per RBI Rules

How will I receive my interest on FD

Your registered bank account will receive the interest on your FD.

What happens when a depositor dies?

In the tragic case of a depositor’s death, the corporation will return the deposit, regardless of the lock-in term. Upon request, the surviving depositor(s), nominee, or legal heir(s) may collect the deposit on behalf of the deceased depositor by presenting proof of death and other required papers.

When a FD reaches maturity, what happens?

Since Shriram Finance provides choices for both auto-renewal and auto-refund, Investcorpus can assist you in obtaining both. The depositor has the option of selecting either auto-renewal or auto-refund when making a fixed deposit reservation. These are the options available to the depositor at maturity if they haven’t selected one of the above.

On the day of maturity, renew your principal.

On the day of maturity, renew your interest rate.

When the fixed deposit matures, close it.

Who is qualified to invest with Shriram Finance Limited at a fixed rate?

Shriram Finance Limited accepts investments from individuals, companies, partnership firms, Hindu Undivided Family (HUF), trusts and foundations, incorporated associations or bodies of individuals, and NRI.