3 Best Multi Asset Allocation Funds for 2025

Quick Overview

Here we discusses the current state of the Indian equity market, which has seen a significant correction since its peak in September 2024. Given this backdrop, it emphasizes the importance of a balanced investment strategy through Multi Asset Allocation Funds for 2025. These funds invest in a mix of asset classes—equity, debt, and gold—providing diversification and potentially reducing risks associated with market volatility.

Key Points

- Market Correction: The Indian equity market has corrected by -11.9% since its peak in September 2024, with mid-cap and small-cap indices experiencing even larger declines.

- Importance of Diversification: A balanced approach to investing is recommended, particularly through Multi Asset Allocation Funds, which invest in at least three asset classes.

- Fund Characteristics: These funds typically allocate 35%-65% in equities, 25%-55% in debt, and up to 20% in gold, with some also including derivatives and international investments.

- Market Risks: Geopolitical tensions, economic factors, and corporate earnings concerns present significant risks to the Indian equity market in 2025.

- Advantages of Multi Asset Allocation Funds: These funds offer tactical diversification, professional management, and the potential for better risk-adjusted returns.

Detailed Breakdown

1. Current Market Context

The Indian equity market has faced notable volatility, with the BSE Sensex experiencing a substantial correction from its peak of 85,836.12 points in September 2024. As of January 15, 2025, the market has dropped by -11.9%. This decline has been attributed to various factors, including geopolitical tensions and economic uncertainties, making it crucial for investors to adopt a more cautious and diversified investment strategy.

2. Understanding Multi Asset Allocation Funds

Multi Asset Allocation Funds are hybrid mutual funds that invest in a minimum of three asset classes: equity, debt, and gold, with at least 10% allocated to each. Typically, these funds are structured to allocate around:

- Equities: 35%-65%

- Debt: 25%-55%

- Gold: Up to 20%

Some funds may also invest in derivatives, real estate investment trusts (REITs), and international equities. The primary objective of these funds is to generate modest capital appreciation and income while minimizing overall portfolio risk through diversification.

3. Factors Influencing Investment Decisions

Fund managers of Multi Asset Allocation Funds have the flexibility to adjust allocations based on various factors, including:

- Valuations: Analysis of Price-to-Earnings (P/E) and Price-to-Book Value (P/BV) ratios compared to historical averages.

- Interest Rates: Consideration of the prevailing interest rate cycle, whether rates are expected to rise or fall.

- Macroeconomic Conditions: Global and domestic economic factors, including geopolitical tensions and market sentiment.

4. Risks Facing the Market

In 2024, multiple factors influenced the Indian equity market’s performance, including:

- Geopolitical Tensions: Conflicts involving Israel, China, and Russia have heightened market uncertainties.

- Economic Indicators: A slowdown in corporate earnings and foreign portfolio investment withdrawals have raised concerns.

- Valuation Premiums: Indian equities are currently trading at a premium compared to global indices, with the MSCI India Index showing a P/E ratio of nearly 22x, significantly higher than its global peers.

5. The Case for Multi Asset Allocation Funds in 2025

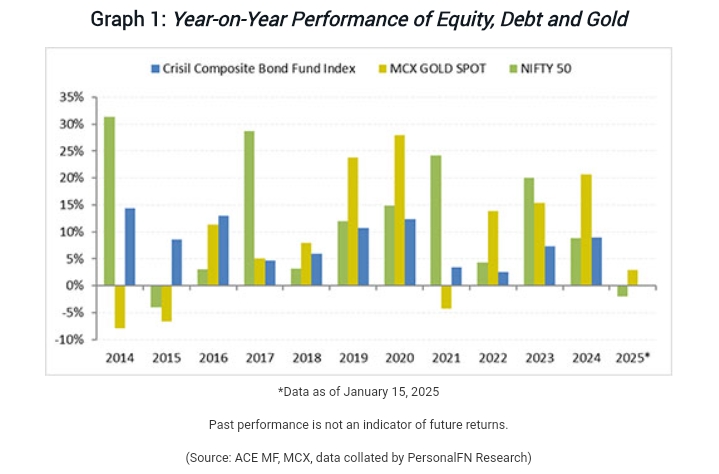

Given the prevailing risks, a diversified investment strategy through Multi Asset Allocation Funds is advisable. These funds can mitigate the impact of negative movements in one asset class by balancing it with other asset classes, thereby protecting capital and optimizing returns. We emphasizes that not all asset classes perform similarly, and during downturns in equities, debt or gold may provide better returns.

Important Details & Evidence

- Performance Data: The article includes a table listing several Multi Asset Allocation Funds in India, highlighting their Assets Under Management (AUM) as of December 31, 2024. For example, the ICICI Pru Multi-Asset Fund has an AUM of Rs 51,027 crore.

- ICICI Pru Multi-Asset Fund- 51,027

- Kotak Multi Asset Allocation Fund -7,679

- SBI Multi Asset Allocation Fund- 6,983

- UTI Multi Asset Allocation Fund- 4,963

- Nippon India Multi Asset Allocation Fund- 4,850

- HDFC Multi-Asset Fund- 3,844

- Aditya Birla SL Multi Asset Allocation Fund- 3,691

- Tata Multi Asset Opp Fund- 3,490

- Quant Multi Asset Fund -3,201

- Graphical Evidence: A graph illustrates the year-on-year performance of equity, debt, and gold, showcasing how different asset classes can perform under varying economic conditions.

Advantages of Multi Asset Allocation Funds

- Tactical Diversification: Reduces downside risk by spreading investments across multiple asset classes.

- Professional Management: Fund managers handle the timing and monitoring of different asset markets.

- Timely Rebalancing: Managers can adjust the portfolio based on market performance and outlook.

- Research-Driven Decisions: Investors benefit from the research capabilities of the fund management team.

- Cost Efficiency: Generally lower costs compared to managing multiple individual funds.

- Risk Management: Enhanced ability to manage risks and optimize returns.

- Simplified Tracking: Easier for investors to monitor a single fund rather than multiple investments.

Final Takeaways

Investing in Multi Asset Allocation Funds presents a strategic approach for navigating the uncertainties of the current market environment. With the Indian equity market facing significant challenges, these funds offer a diversified investment solution that can help protect against volatility and enhance long-term returns. By tactically allocating across equity, debt, and gold, investors can better manage risks and potentially achieve more favorable risk-adjusted returns. In 2025, adopting a balanced investment strategy through these funds could be a prudent choice for investors looking to