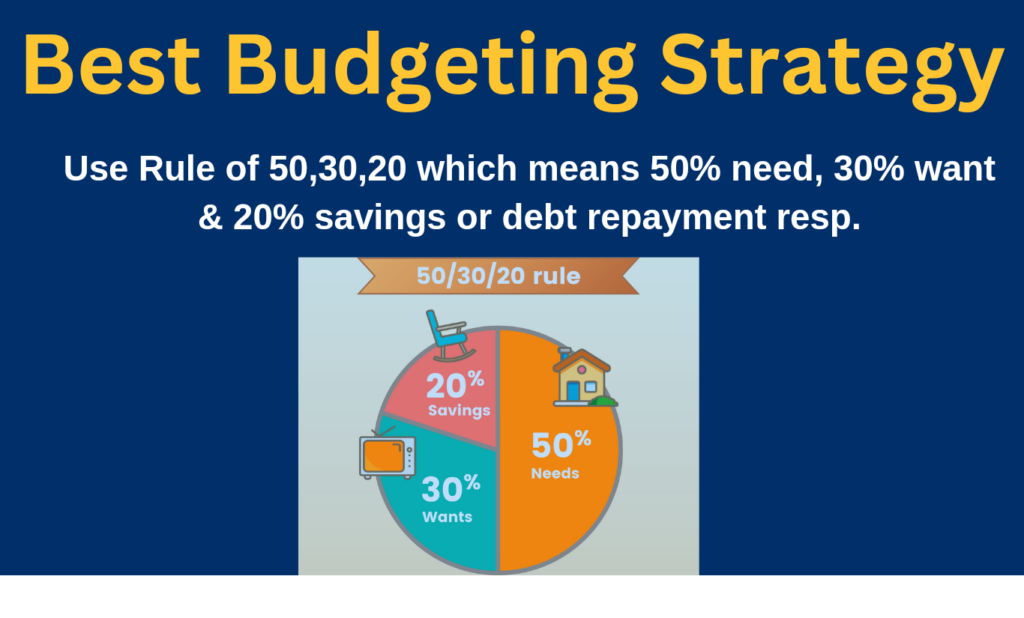

Best Budgeting Strategy: Use Rule of 50,30,20 means need, want & savings or debt repayment resp.

The 50/30/20 rule is a budgeting method that aids in managing after-tax income, promoting financial balance, savings, and debt reduction, making it an effective starting point for creating a sustainable budget.

The 50/30/20 rule is a budgeting strategy that divides after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

The 50/30/20 rule promotes long-term goals by balancing spending on necessities and indulgences, ensuring a financial cushion, and incorporating debt repayment for faster loan repayment.

The 50/30/20 rule is a financial management strategy that involves allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

This involves dividing your monthly expenses into needs, wants, and savings categories.

If your spending on wants exceeds 30%, reallocate the money towards savings or debt reduction. Automating your finances and regularly reviewing your budget can help maintain its alignment with your goals. This approach helps you stay on track with your financial goals.

The 50/30/20 rule is a financial management strategy that involves tracking expenses, starting small, prioritizing high-interest debt, and adjusting for irregular income. It helps balance immediate needs, lifestyle choices, and long-term goals, reducing financial stress and promoting a secure future. You can use popular budgeting app available on playstore.