2025 will be a hard year for equity markets, Know why?

The performance of equities markets in 2025 continues to be a top concern for investors as the globe struggles with persistent geopolitical tensions and increased dangers of economic downturns.

Let’s discusse important elements that will significantly influence market paths, including changes in sector-specific trends, inflationary pressures, global trade dynamics, and monetary policy adjustments.

While historical resiliency provides some hope, the interaction of these variables could lead to increased volatility, presenting both problems and opportunities for investors in the next year.

What is the state of the equities market right now?

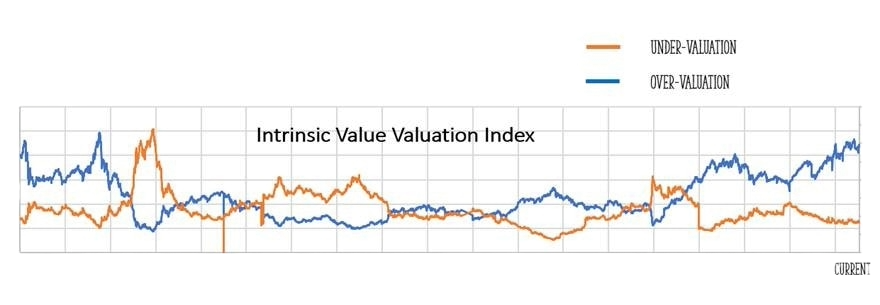

The Orange Line shows undervaluation, whereas the Blue Line represents overvaluation. Whenever this Tool has exhibited such divergence with overvaluation on the high side, we have seen big declines within the next 3-6 months, whether in 2008, 2017, 2021, or today.

The same is true for bull rallies: whenever divergence occurs on the opposite side, it indicates a rally, as seen in 2009, 2012, 2014, and 2020. As value investors, we analyze the country’s growth potential, but this valuation has helped us identify potential market traps and opportunities. So, we need to hunt for those few places where the market is undervalued and start looking at these chances.

Given the continued geopolitical tensions and anticipated economic downturns, how do you think equities investments will perform in 2025?

What variables are likely to have a substantial impact on equity market performance in 2025?

Geopolitical tensions have never been bad news for the market, despite how the media portrays them. However, Trump’s win may result in some trade confrontations, as it did previously. However, if we invest in undervalued quality companies, the effect will be close to nothing.

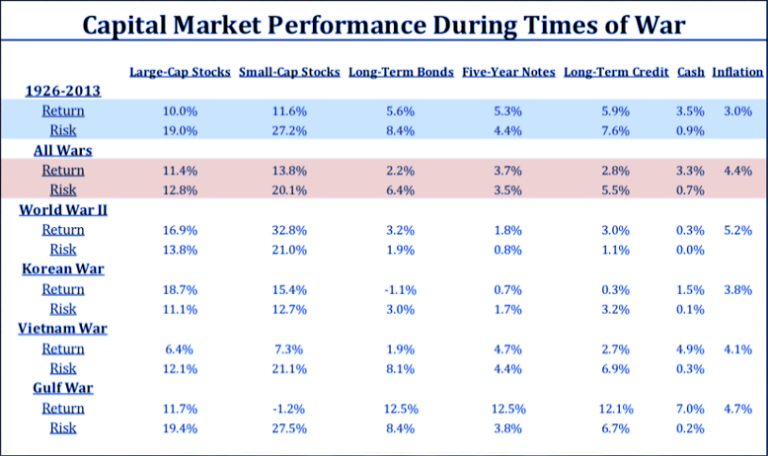

Returning to the topic of conflicts, consider the market performance during times of war.

Since the conflict between Russia and Ukraine began in February 2022, retail investors have been waiting for a correction; nevertheless, we witnessed a single, massive bull rally instead.

As I mentioned, the market might be right, but it will happen on its own initiative rather than as a result of war. 2025 may be a difficult year, but it is nothing we haven’t already witnessed in the previous ten to twelve years of the market.

Investing in momentum and growth may be challenging due to the risk of overpriced and overhyped assets experiencing reversion to mean, as bear markets test behavior and plans.