Section 115BAC of the Income Tax Act: Old Tax Regime vs. New Tax Regime

Quick Overview

The article discusses Section 115BAC of the Income Tax Act, which introduces a new tax regime in India that offers lower tax rates but requires taxpayers to forgo certain deductions and exemptions. The piece contrasts this new regime with the old tax regime, helping readers understand the implications of each choice and how to determine which is more beneficial for their financial situation.

Key Points

- Introduction to Section 115BAC: This section was introduced in the 2020 budget to provide an alternative tax regime with reduced tax rates.

- Comparison of Tax Rates: The new regime features lower tax rates for various income slabs compared to the old regime.

- Deductions and Exemptions: The new tax regime requires taxpayers to give up several common deductions and exemptions, which could impact overall tax liabilities.

- Choosing Between Regimes: Taxpayers must evaluate their financial situation to decide which regime is more advantageous based on their income and eligible deductions.

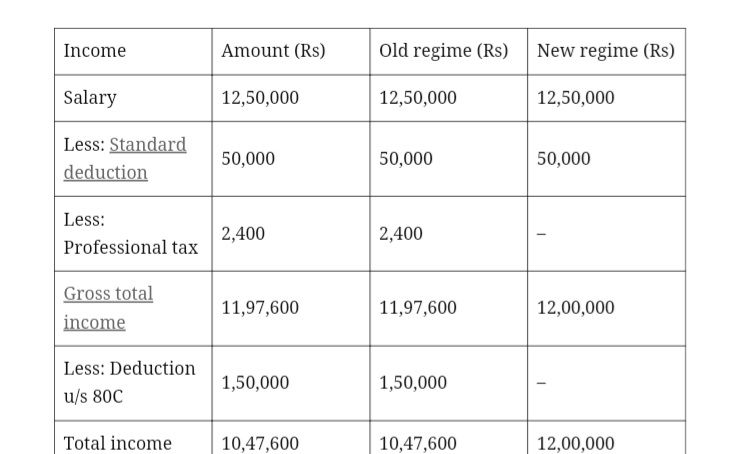

- Examples and Scenarios: The article provides practical examples to illustrate how the tax burden differs under both regimes.

- Simplicity vs. Savings: While the new regime simplifies tax calculations, it may not always lead to savings for those who can leverage deductions effectively.

Taxpayers are encouraged to calculate their tax liabilities under both regimes to see which offers a lower tax burden.

5. Examples and Scenarios

The article provides examples to illustrate the practical implications of choosing between the two regimes:

- Example 1: A taxpayer with an income of ₹10 lakh, claiming deductions of ₹2 lakh under the old regime, would pay less tax compared to opting for the new regime, which does not allow these deductions.

- Example 2: A taxpayer earning ₹8 lakh with minimal deductions may find that the new regime results in a lower tax liability due to the reduced rates.

These scenarios help clarify how the choice of tax regime can significantly affect tax outcomes.

Important Details & Evidence

- Tax Savings Potential: The article emphasizes that while the new tax regime offers lower rates, the overall tax savings depend heavily on individual circumstances, particularly the amount of deductions claimed.

- Flexibility: Taxpayers can switch between the two regimes annually, providing flexibility to adapt to changing financial situations.

- Impact on Financial Planning: The choice between the two regimes can affect financial planning strategies, especially for taxpayers who are accustomed to maximizing deductions.

Final Takeaways

Choosing between the old and new tax regimes under Section 115BAC of the Income Tax Act requires careful consideration of individual financial situations. While the new regime offers lower tax rates, it comes at the cost of forgoing various deductions and exemptions, which may not be advantageous for everyone. Taxpayers should evaluate their income, deductions, and overall financial goals to make informed decisions. Ultimately, the right choice can lead to significant tax savings and a more straightforward tax filing process.