5 Railways MF to increase the value investment portfolio

Investing in railway-focused mutual funds or rallway mutual fund list can be a wise move for your investment portfolio, particularly given the ongoing modernization of the Indian Railways. This dynamic sector is poised to offer substantial growth opportunities in the coming years.

Over the past decade (2014-2024), the Indian Railways haveone a remarkable transformation. A strong emphasis has been placed on doubling railway tracks, which has enhanced efficiency, alleviated congestion, and facilitated smoother traffic flow. This has resulted in quicker journey times for passengers. Furthermore, the introduction of the Vande Bharat Express, a modern train with superior amenities and accelerated speeds, has elevated the overall travel experience.

Historically, the sector has been dominated by government-owned enterprises. However, this landscape is gradually shifting towards privatization, particularly in such as engineering, ticketing, and other maintenance and operational aspects. The adoption of digital platforms and mobile applications has also streamlined the ticketing process, making it more convenient for passengers to book their tickets.

As the Indian Railways continue to advance towards ensuring safer, faster, and more comfortable travel for passengers, investing in-focused mutual funds can be a strategic move. The increased focus on modern and efficiency within the sector has the potential to contribute to the appreciation of your stock holdings, providing stability and growth opportunities to your investment portfolio. diversifying your investments to include railway-focused funds, you can capitalize on the ongoing transformations within the Indian Railways and potentially enhance the overall performance of your investment portfolio.

Investing in Public Sector Undertaking funds (PSU) funds that allocate a portion of their assets to railway stocks can be a strategic move for diversifying your investment portfolio and potentially enhancing. The railway sector in India is undergoing a phase of modernization and growth, which presents compelling opportunities for investors.

The upcoming Union Budget announcement on July 23rd is expected to further bolster the railway industry, making this an opportune time to explore PSU funds with a focus on railway stocks. These funds offer concentrated exposure to directly involved in railway operations and infrastructure, which can align with government objectives and benefit from budget-driven developments.

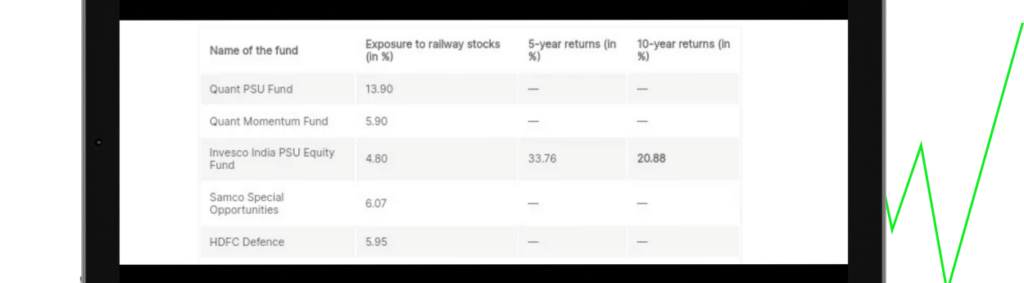

A review of the leading mutual funds in India reveals several options that have a significant allocation to railway stocks. These PSU funds provide investors with the advantages of professional management an inherent diversification comes with mutual fund investments.

Investing in railway-focused PSU funds can be particularly advantageous for the following reasons:

- Concentrated Exposure: These funds dedicate a substantial portion of their assets to companies directly involved in the railway industry, offering investors a focused approach to capitalizing on the growth prospects of this sector.

- Alignment with Government Objectives: As PSUs, these companies are often well-positioned to benefit from government policies and initiatives aimed at and modernizing the railway infrastructure in India.

- Potential for Improved Financial Performance: The anticipated budget announcements related to railway development could positively impact the financial performance of the companies held within these PSU funds, potentially leading to enhanced returns for investors.

- Diversification: By incorporating railway-focused PSU funds into a diversified investment portfolio, investors can enhance the risk-return profile of their holdings, potentially reducing volatility and capturing the unique growth opportunities within the railway industry.

By leveraging the of professional fund managers and the diversification inherent in mutual fund investments, investors can strategicallyate a portion of their portfolio to railway-oriented PSU funds. approach can allow them to capitalize on the growth prospects of the railway sector, which appears poised for further expansion and development in the wake of the upcoming Union Budget.

Rallway Mutual Fund list

Diversifying your investments across multiple railway companies through mutual funds can provide a more effective risk reduction strategy compared to investing in individual stocks. Mutual fun leverage their specialized industry and conduct extensive research to carefully select promising railway stocks, offering investors a more informed and professional approach to portfolio management. This diversified approach helps mitigate the risks associated with relying on a single company’s performance, ultimately providing investors with a more balanced and potentially more stable investment opportunity in the railway sector.

Mutual fund investing undoubtedly has the potential to increase wealth. Making sure the fund fits your investing goals and risk tolerance is very important. However, before making your next investment decision—especially one involving stocks in the stock market—it might be wise to speak with a financial counselor.