Why, in a volatile market, are aggressive hybrid funds a wise investment?

Synopsis:

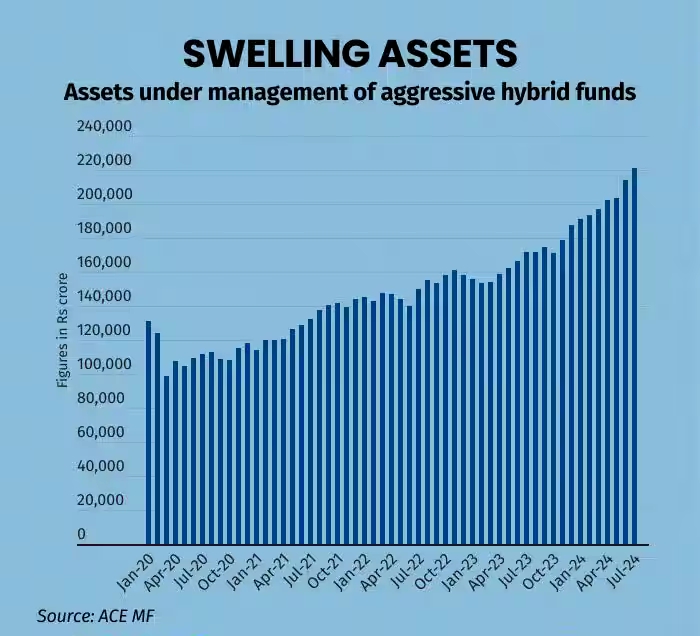

Unlike pure equity funds, aggressive hybrid funds let investors ride out the gain while protecting their downside. Even the most successful aggressive hybrid fund designs have produced returns that are on par with those of the large-cap fund class. Aggressive hybrid funds, which invest 65-80% in equities and the rest in debt, offer a balance between growth and risk management, delivering better returns and lower volatility compared to pure equity investments.

Aggressive hybrid funds can be a good investment option for investors in a volatile market. These funds invest 65-80% in equities and the rest in debt, providing a balance between growth potential and risk management.

Compared to pure equity funds, aggressive hybrid funds have delivered better returns and lower volatility. They can be a valuable part of a diversified portfolio, offering growth potential with lower risk than pure equity investments.

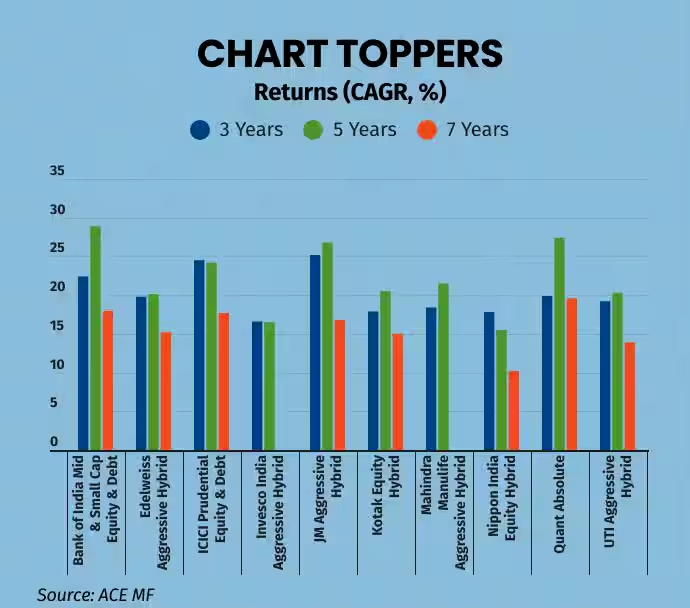

Here is a list of Top Performer Aggressive hybrid funds

However, investors should be aware of the risks involved, as the equity component can lead to losses during market downturns.

1. What is the key advantage of aggressive hybrid funds compared to pure equity funds?

Aggressive hybrid funds allow investors to take advantage of the upside potential of equity markets, but with a more controlled risk profile compared to purely equity funds.

The main advantages of aggressive hybrid funds compared to pure equity funds:

- They allow investors to participate in market rises, while also cushioning the falls, providing better risk management.

- They invest between 65-80% in stocks and the rest in debt, which provides a balance between growth potential and stability.

- They have delivered better returns and lower volatility than pure equity funds over time.

- They offer an interesting option for investors with moderate risk profiles who want to participate in the equity markets, but with additional protection against volatility.

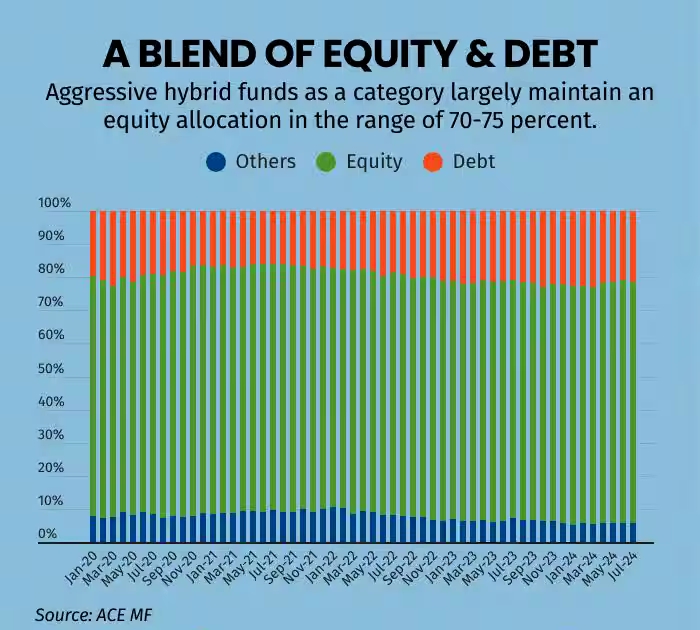

2. What is the typical asset allocation of aggressive hybrid funds?

The typical asset allocation of aggressive hybrid funds is around 65-80% in stocks and the remaining 20-35% in debt instruments. This combination allows them to offer a risk-return profile that is intermediate between pure equity funds and fixed income funds.

3. How have aggressive hybrid funds performed compared to large-cap funds and the overall market?

Aggressive hybrid funds have performed quite well compared to large-cap funds and the overall market:-

On a 3-year and 5-year basis, the aggressive hybrid funds category has delivered annualized returns between 16.04% and 18.35% on average.

This performance has matched or even exceeded the returns of top performing large-cap funds over the same time periods.

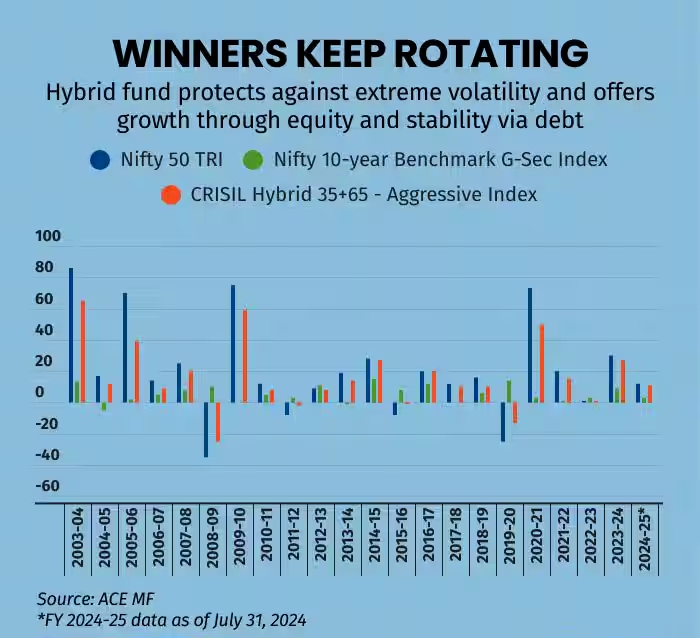

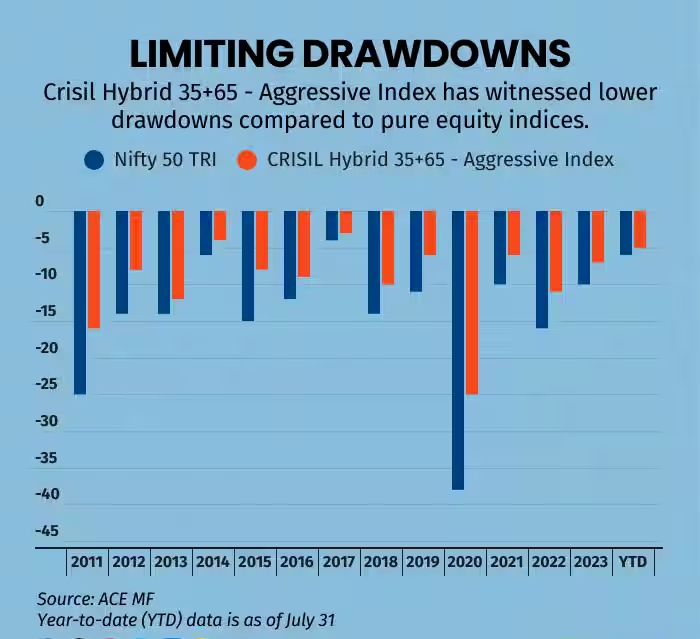

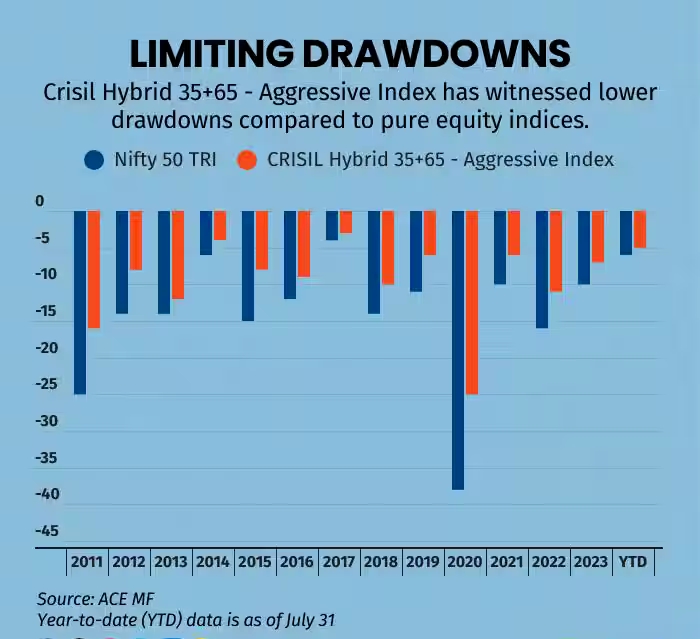

- The Crisil Hybrid 35+65 – Aggressive Index, which is used as a benchmark by many aggressive hybrid funds, has also shown lower drawdowns compared to pure equity indices during market downturns.

The analysis suggests that aggressive hybrid funds can provide equity-like returns with lower volatility compared to pure equity funds. This makes them a valuable option for investors looking to balance growth potential and risk management in their portfolios. The equity allocation allows for participation in market upswings, while the debt component helps cushion against extreme market volatility.

So in summary, aggressive hybrid funds have demonstrated the ability to deliver competitive returns versus large-cap funds and the broader market, while offering a smoother ride for investors. This performance profile can make them an attractive choice as part of a diversified investment strategy.

4. What are the potential drawbacks of investing in aggressive hybrid funds?

1. Equity market volatility: Since aggressive hybrid funds have a significant allocation to equities (typically 65-80%), they are susceptible to the volatility in the equity markets. During market downturns, the equity component can lead to higher losses compared to pure debt funds.

- Interest rate risk: The debt portion of the portfolio is exposed to interest rate risk. When interest rates rise, the value of the debt instruments in the portfolio can decline, impacting the overall fund performance.

- Lower stability compared to conservative hybrid funds: Aggressive hybrid funds have a higher allocation to equities, which makes them less stable compared to conservative hybrid funds that have a higher allocation to debt instruments.

- Potential underperformance during prolonged bear markets: In a prolonged bear market scenario, aggressive hybrid funds may underperform pure equity funds, as the debt component may not be able to fully cushion the downside.

- Higher risk profile: Aggressive hybrid funds have a higher risk profile compared to conservative hybrid funds or pure debt funds, which may not be suitable for risk-averse investors.

So in summary, the higher equity exposure, interest rate risk, and overall volatility are the key drawbacks that investors should be aware of when investing in aggressive hybrid funds.

5. Who are the target investors for aggressive hybrid funds?

The target investors for aggressive hybrid funds are those seeking a balance of growth and risk management, have a moderate risk appetite, and are investing for the long-term as part of a diversified portfolio, Reason Below:

- Investors seeking a balance of growth potential and risk management:Aggressive hybrid funds offer a blend of equity exposure for growth potential, along with a debt component to provide some stability and risk management. This makes them suitable for investors who want to participate in the upside of equity markets, but with lower volatility compared to pure equity funds.

- Investors with a moderate risk appetite:

Since aggressive hybrid funds have a significant allocation to equities (typically 65-80%), they are suitable for investors with a moderate risk appetite. These investors are willing to take on more risk compared to conservative investors, but are not comfortable with the high volatility of pure equity funds. - Long-term investors:Aggressive hybrid funds are better suited for long-term investors who can withstand market volatility and ride out the ups and downs of the equity markets over a longer investment horizon, typically 5 years or more.

- Investors looking to diversify their portfolio: Aggressive hybrid funds can be a valuable addition to a diversified investment portfolio, providing exposure to both equity and debt assets.