Budget 2025: Current Gold Market and Import Duties Increase; Jan 28, 2025

As India gears up for the Budget 2025 announcement, the gold market is on high alert due to a potential hike in import duties. This speculation arises from record-high gold imports that are contributing to a growing trade deficit. Industry experts are concerned that any increase in duties could impact the jewelry sector, which has benefited from previous reductions.

Record Gold Imports

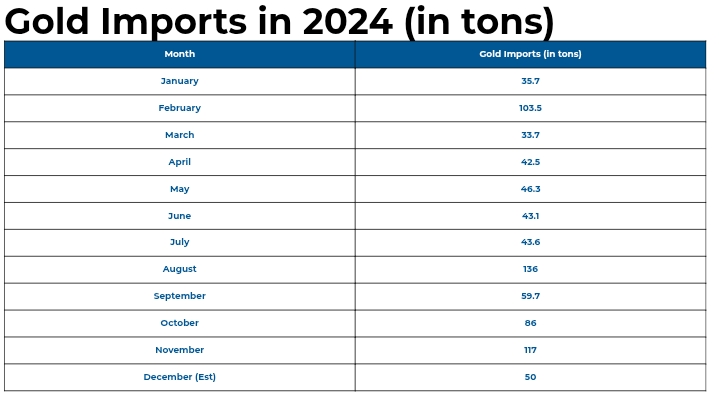

India’s appetite for gold has reached new heights, with imports climbing significantly since the duty cuts were implemented. In August alone, following the duty reduction, gold imports soared by 104% year-on-year. Monthly data indicates a consistent trend, with November recording 117 tons of gold imported. The following table illustrates this trend:

| Month | Gold Imports (in tons) | |————-|————————| | January | 35.7 | | February | 103.5 | | March | 33.7 | | April | 42.5 | | May | 46.3 | | June | 43.1 | | July | 43.6 | | August | 136 | | September | 59.7 | | October | 86 | | November | 117 | | December (Est) | 50 |

Historic Duty Cuts

The 2024 Union Budget marked a pivotal moment for the gold market, implementing a historic 9% cut in import duties. This reduction lowered the duty from 15% to 6% for standard gold and from 14.35% to 5.35% for gold dore imports. While this move was celebrated by the jewelry industry, it has also led to unintended consequences, such as a growing trade deficit.

Economic Implications

Despite the positive impact on consumption, economists warn that the duty cuts have not translated into increased domestic value addition or higher exports. The surge in gold imports has exacerbated India’s trade deficit, with the rupee depreciating against the dollar, raising concerns about the overall economic stability.

Industry Reactions

In light of the impending Budget 2025, the jewelry sector is urging the government to maintain the lower import duties. They argue that these cuts have not only made gold more accessible but have also reduced the profitability of gold smuggling. The jewelry industry claims that the financial relief from lower duties has bolstered their competitiveness and improved cash flow.

Final Takeaways

As Budget 2025 approaches, the gold market is caught in a delicate balance. While record imports highlight the demand for gold in India, the potential for increased import duties poses a threat to the jewelry industry’s recent gains. The sector remains optimistic that the government will recognize the benefits of maintaining lower duties, which have contributed to a healthier market. The outcome of the upcoming budget could significantly shape the future of gold consumption and trade in India.