The Indian government plans to amend insurance law to allow a unified license and increase the 100% FDI limit in the upcoming amendment bill

Currently browsing: Uncategorized

Mutual Funds: Despite the market correction, experts remain positive about areas such as infrastructure, information technology, pharmaceuticals, and financial services

Analysts are optimistic about investment themes in infrastructure, IT, pharmaceuticals, Banking and financial services, despite […]

America’s Rising Debit to GDP ratio Crosses 200%, Can Trump’s Department of Government Efficiency save America from bankruptcy?

America’s Rising Debit to GDP ratio Crosses 200%, Can Trump’s Department of Government Efficiency save America from bankruptcy?

Inflation Calculator: How much will ₹5 crore be worth in three, five, or ten years?

Using the inflation rate, the inflation calculator assists you in estimating the future value of […]

SWP vs IDCW – Understanding Payouts & Tax-Efficent Plan for Optimal Financial Health

SWP vs IDCW – Understanding Payouts & Tax-Efficent Plan for Optimal Financial Health

FIIs pumped ₹11,100 crore in stocks, while DIIs net sold ₹1,910.86 crore yesterday.

FIIs pumped ₹11,100 crore in stocks, while DIIs net sold ₹1,910.86 crore yesterday.

Foreign institutional investors (FIIs) invested ₹1,157.70 crore in shares on November 26, leading to a rejig of the MSCI index. This rebalancing and political stability have boosted market sentiment, with domestic institutional investors selling equities worth ₹1,910.86 crore. The MSCI rejig included five Indian firms, triggering passive inflows estimated at $2.5 billion. Analysts caution against a full-fledged return of FIIs to Indian equities due to the Nifty 50 and Sensex remaining under pressure. CLSA, a brokerage firm, has reversed its ‘overweight’ stance on India, despite significant net foreign investor selling since October, indicating a decline in the China growth narrative.

Calculator for Mutual Funds: Rs 3000 SIP at 30? This is the amount you will receive upon retirement

Calculator for Mutual Funds: Rs 3000 SIP at 30? Know the amount you will receive upon retirement.

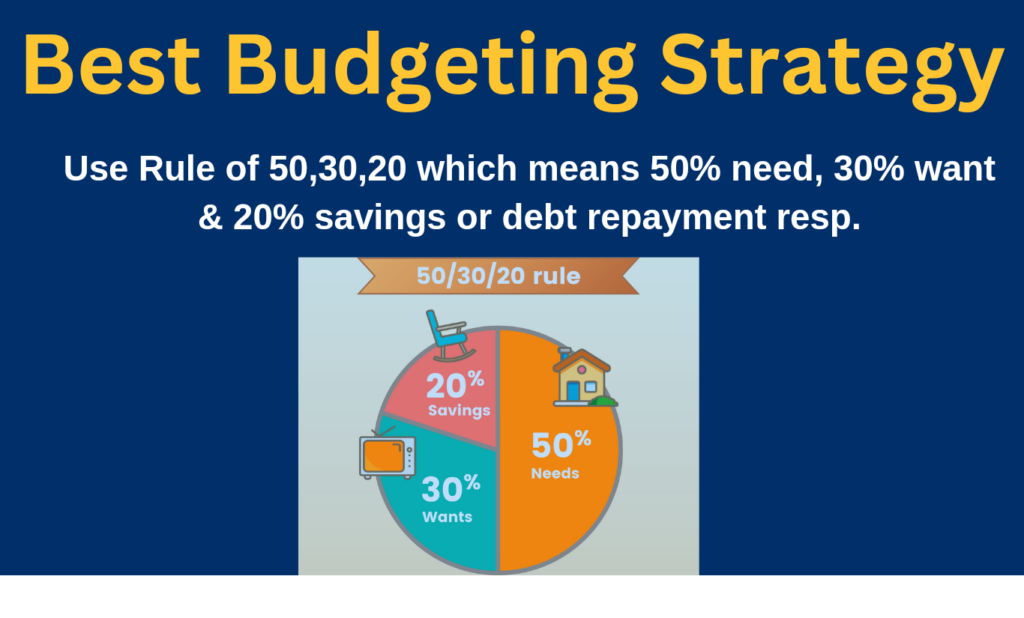

Best Budgeting Strategy: Use Rule of 50,30,20 means need, want & savings or debt repayment resp.

The 50/30/20 rule is a budgeting method that aids in managing after-tax income, promoting financial […]

FIIs turn net buyers after 38 consecutive sessions, buy shares worth Rs 9,948 crore

Stock Market Overview: FII & DII

How to Opt Out of EPF?

Know best alternatives of EPF & how to Opt Out of EPF?

Mutual Fund, NPS & PPF can be best alternatives for savings.