Do you think taxes are too high in India? Know what is the tax-GDP ratio of Europe: Taxation and economic health in different countries

Quick Overview

This analysis delves into the complexities of taxation, particularly the tax-to-GDP ratios in various countries, and their implications for entrepreneurs. Josh Gardner, a Chinese industrialist, emphasizes the importance of understanding these ratios to navigate the business landscape effectively. The discussion contrasts the high tax burdens in European nations with the lighter tax loads in countries like India and Indonesia, highlighting the balance necessary for fostering economic growth without hindering innovation.

Key Points

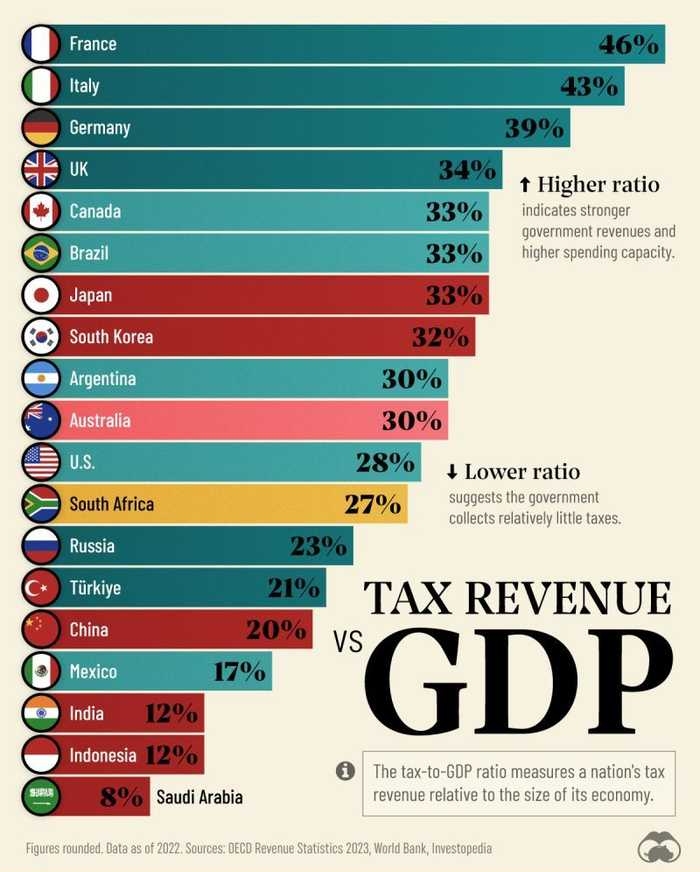

- Global Tax-to-GDP Ratios: The tax-to-GDP ratio serves as a critical indicator of a country’s economic health and the burden of taxation on businesses.

- Low Tax Burdens vs. Public Services: Countries with lower tax-to-GDP ratios often face challenges due to underdeveloped public services and infrastructure, which can affect entrepreneurial activities.

- High Tax Countries: European nations such as France, Italy, and Germany exhibit high tax-to-GDP ratios, which fund public services that can indirectly support business growth.

- Entrepreneurial Perspective: Entrepreneurs often perceive taxes as a burden, but understanding the broader economic context can aid in strategic planning.

- Finding the Right Balance: The key challenge lies in achieving a balance where taxes support economic health without stifling business innovation.

Detailed Breakdown

Global Tax-to-GDP Ratios

Josh Gardner highlights the significance of the tax-to-GDP ratio, pointing out that countries like India and Indonesia maintain lower ratios. This situation translates to a lighter tax burden for businesses, which can encourage entrepreneurial activities. However, the trade-off is often seen in the form of inadequate public services and infrastructure, which can create obstacles for business operations.

Low Tax Countries: Challenges and Opportunities

While lower taxes may seem advantageous, Gardner notes that they often correlate with less developed public services. This can pose unique challenges for entrepreneurs who rely on robust infrastructure and support systems. The absence of these services can hinder business growth and innovation, creating a paradox where low taxes do not necessarily equate to a favorable business environment.

High Tax Countries: A Different Landscape

In contrast, countries like France, Italy, and Germany, with tax-to-GDP ratios exceeding 39%, impose a significant tax burden on businesses. However, these taxes fund essential public services and infrastructure, which can provide indirect benefits by fostering a conducive environment for business growth. Gardner suggests that while high taxes can be perceived negatively, they also play a crucial role in sustaining a healthy economy.

Entrepreneurial Perspective on Taxes

Gardner acknowledges the frustration entrepreneurs feel regarding taxes, which can diminish profits. He argues that understanding the global tax landscape is crucial for strategizing business operations. By recognizing where their countries stand in relation to others, entrepreneurs can make informed decisions that align with their growth objectives.

Striking the Balance

The overarching theme of Gardner’s argument is the need to find a balance in taxation. He advocates for a tax structure that supports economic health without stifling innovation. This balance is essential for creating an environment where businesses can thrive while contributing to the overall economy.

Important Details & Evidence

- Tax-to-GDP ratios serve as a vital metric for assessing a country’s economic health and business climate.

- Countries with lower tax burdens may lack essential public services, impacting entrepreneurial success.

- High tax nations, while burdensome, often provide the infrastructure necessary for business growth.

- Entrepreneurs need to consider global tax contexts to strategize effectively.

Final Takeaways

Understanding the nuances of tax-to-GDP ratios is essential for entrepreneurs navigating the global business landscape. While lower taxes may offer immediate relief, they can come at the cost of inadequate public services. Conversely, higher taxes can provide the necessary infrastructure for sustainable growth. Ultimately, finding the right balance in taxation is crucial for fostering an environment conducive to innovation and economic success.