Gold prices in India decreased on Jan 13, 2025, contrasting stock indices Sensex and Nifty, despite demonstrating market resilience

Quick Overview

On January 13, 2025, gold prices in India experienced a decrease, contrasting with the declines seen in major stock indices like Sensex and Nifty. Despite this, gold continues to show resilience in the market. Let us show you insights into the current gold rates, market trends, and factors influencing gold prices across major Indian cities.

Current Gold Rates

As of January 13, 2025, the retail prices for gold in India are as follows:

- 22-Karat Gold: Rs 73,400 per 10 grams

- 24-Karat Gold: Rs 80,070 per 10 grams

These prices illustrate the ongoing fluctuations in the gold market, which can be attributed to a mix of domestic and international factors.

Recent Price Changes

Over the past week, 24-karat gold has increased by 0.98%, while a more substantial increase of 2.0% has been observed over the last month. This trend indicates a gradual rise in gold’s value, despite the recent dip on January 13.

International Market Trends

In the international market, gold prices are showing some stability, with spot gold priced at approximately $2,687.56 per ounce and COMEX prices at $2,715 per troy ounce. These figures highlight the global demand for gold and its role as a safe-haven asset amid economic fluctuations.

Market Influences

Gold prices are subject to a variety of influences:

- Global Demand: Changes in demand from major markets can impact prices significantly.

- Interest Rates: Higher interest rates typically lead to lower gold prices, while lower rates can boost demand.

- Currency Exchange Rates: Fluctuations in currency values, particularly the US dollar, can affect gold prices.

- Geopolitical Events: Political instability or economic uncertainty often drives investors toward gold, increasing its price.

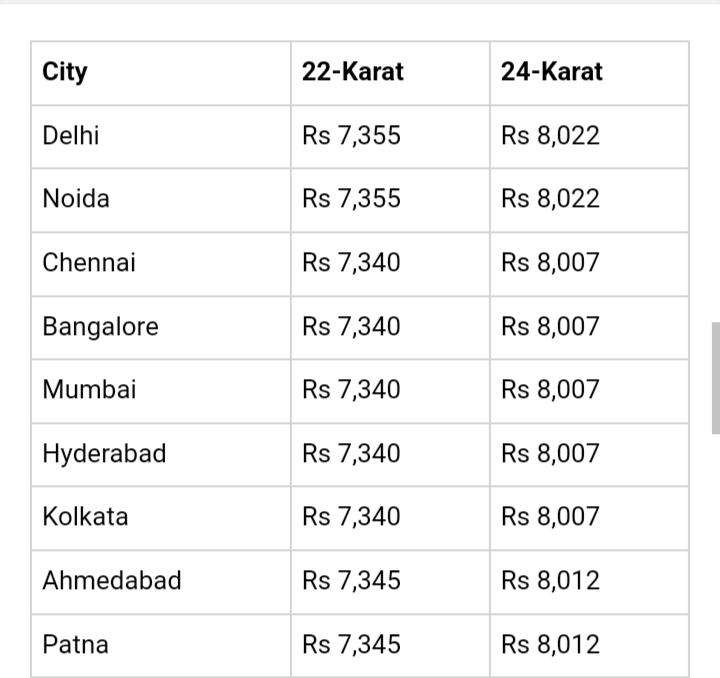

Price Variations Across Cities

Gold prices can vary from city to city in India due to local demand and market conditions. A detailed list of prices across major cities would provide further insights into regional trends.

The fluctuation in gold prices is not just a local phenomenon but is affected by a complex interplay of global economic factors. For instance, the recent price changes of 0.98% in the last week and 2.0% in the last month suggest a growing interest in gold as a stable investment option.

Final Takeaways

Gold remains a strong player in the investment market, even as stock indices like Sensex and Nifty show volatility. Investors should keep an eye on international market trends, interest rates, and geopolitical developments, as these factors can significantly influence gold prices. As of now, gold continues to be a reliable asset, reflecting its enduring value amidst changing economic landscapes.