HDFC Bank is dropped from the top 10 holdings and the quant small cap fund’s investment is reduced by more than 5%.

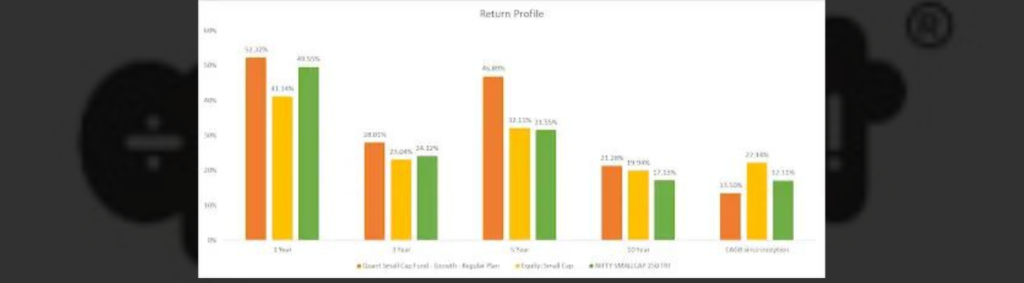

The top 10 holdings of the Quant Small Cap Fund saw a significant change as HDFC Bank was removed and its stake reduced by more than 5%. The fund focuses on investing in small-cap stocks for long-term investors, with a portfolio that includes both medium-term and long-term investments. It primarily consists of high-growth companies with attractive valuations and is relatively under-owned. Launched on November 24, 1996, the scheme (regular plan- growth) observed an increase in assets under management (AUM) from ₹22,967 crore on June 30, 2024, to ₹24,530 crore on July 31, 2024, marking a 6.80% growth within a month. Since inception, the scheme has delivered 13.50% CAGR returns and 52.32% in the past year. Its benchmark is BSE 250 SmallCap TRI, and it has an expense ratio of 1.62%.

During the period from March 24, 2020, to July 31, 2024, the scheme achieved an absolute return of 940.86% while maintaining a portfolio beta of 1.10 (as per factsheet). In July 2024, the portfolio allocation to the top 10 holdings decreased from 46.03% to 42.19%.

The portfolio primarily consists of small caps at 66.33%, with large caps at 18.49% and mid-caps at 2.27%. In contrast, the allocation in June 2024 favored large caps at 31.30% and had lower mid-cap allocation at 0.38%. These adjustments indicate caution taken by the fund manager in response to geopolitical tensions.

During July 2024, the Quant Small Cap Fund lowered its allocation to top 10 holdings with reductions in Reliance Industries Ltd and Jio Financial Services Ltd while adding Aditya Birla Fashion and Retail Ltd, HFCL Ltd, and Sun TV Network Ltd. Aegis Logistics Ltd. witnessed an increase in allocation from 3.57% to 4.46%. Notably, HDFC Bank Ltd was removed from the top 10 holdings. The portfolio witnessed a decrease in Equity & Equity Related Instruments from 98.17% to 87.09% while witnessing a significant rise in Money Market Instruments and cash from 1.83% to 12.91%.The removal of HDFC Bank Ltd and increased cash levels indicate a strategic shift in the Quant Small Cap Fund’s approach amid market uncertainties.