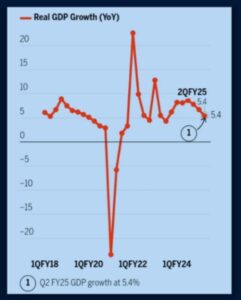

India’s Q2 GDP experienced a short dip due to poor spending, reaching a seven-quarter low of 5.4% in July-September. Capex surge is expected to drive recovery in H2.

INDIA’S GDP NEWS TODAY

The decline In India’s GDP, began earlier this year. Around March – April, the GDP began to decline. The sixth or seventh month is now upon us. The GDP may have reached a low point, indicating that the situation is no longer getting worse.

Prompt action, At that point, prompt action will be essential because if we make Indian market movements better, the economy flows back on itself, if we can’t do so it may worsen.

If we try to resuscitate growth too late, possible potential investments in the share bazar may be put on hold, and we may have to accept a lesser GDP growth rate.

Indian’S GDP review for last few years

- India’s GDP has been declining since March 2024, according to the graph above, with a possible recovery anticipated in February 2024 or March 2024 The downturn has impacted a variety of industries, including cement volume growth, vehicle sales, consumer products, and system credit growth.

Nowadays, Most of the small businesses are struggling as the number of non-performing assets rises day by day, particularly in the retail sectors and micro-finance sectors.

Domestic fiscal and monetary challenges are the root reasons for the GDP slowdown, resulting in an unanticipated contraction in the Indian economy. We feel that if these issues are resolved, growth should resume as our PM expected and said in various election rallies.

The signals of a slowdown are also visible in India’s earnings expectations, with FY26 estimates down and the BSE 200 down by more than 2.0 % in the first 20-21 days of results season.