Middle Class Rising Calls for Tax Relief Before Budget 2025

Growing Demand for Tax Relief

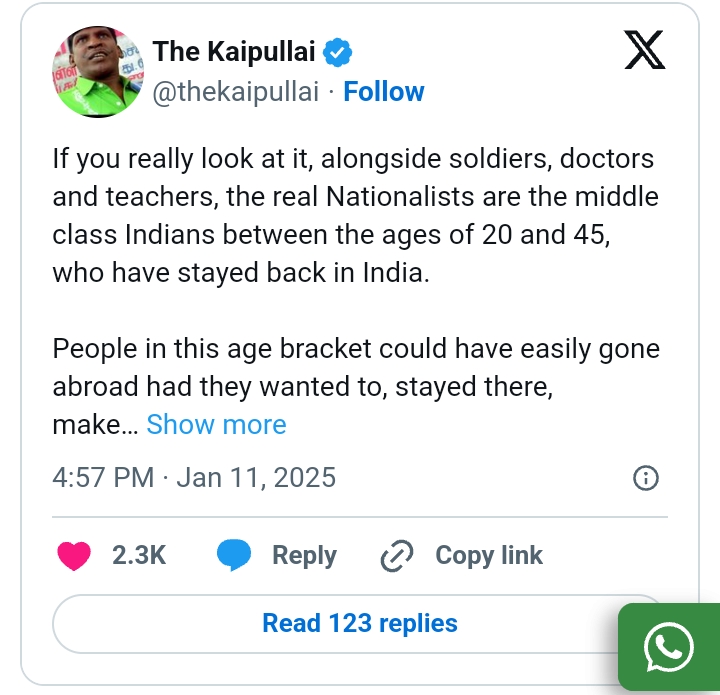

As discussions about Budget 2025 heat up, the middle class in India finds itself at the forefront of calls for tax relief. Many believe that this demographic has been unfairly burdened by high taxes while receiving little in return. Social media discussions, particularly a notable post on X, have highlighted the struggles of middle-class Indians aged 20 to 45, who are portrayed as the unsung heroes of the nation.

The Role of the Middle Class

The middle class is viewed as the backbone of India’s economy, yet their contributions often go unrecognized. The post emphasizes that these individuals have chosen to stay in the country, contributing to its progress despite facing significant challenges. This sentiment resonates with many, leading to a broader conversation about their importance and the need for acknowledgment in national policy discussions.

Expert Opinions on Tax Reforms

Experts have joined the chorus advocating for tax reforms. Finance influencer Akshat Shrivastava points out that the high taxation rates are leading to widespread dissatisfaction among taxpayers. He suggests that a broader tax base and reduced rates could enhance disposable income and encourage spending.

Sanjiv Puri, President of the Confederation of Indian Industry (CII), has proposed reducing the marginal tax rate for individuals earning up to Rs 20 lakh annually, arguing that this would boost consumption and revenue. Similarly, Ranjeet Mehta from the PHD Chamber of Commerce and Industry has called for a restructuring of tax slabs, advocating for a 30% rate for incomes above Rs 50 lakh and a lower rate for those earning between Rs 15 lakh and Rs 50 lakh.

Former Infosys CFO Mohandas Pai has also chimed in, highlighting the disproportionate tax burden on the middle class and suggesting a revised tax structure that includes no tax for incomes up to Rs 5 lakh and graduated rates for higher income brackets.

Public Sentiment and Future Outlook

The collective frustration of the middle class regarding their tax situation is evident. Many believe that the upcoming Budget presents an opportunity for the government to reassess its approach and implement reforms that reflect the needs of this demographic. Shrivastava urges policymakers to adopt a more inclusive and equitable fiscal strategy, emphasizing that significant changes are necessary when current measures are failing.

The call for tax relief for India’s middle class is gaining momentum as the country prepares for Budget 2025. With a strong emphasis on the contributions and challenges faced by this demographic, experts advocate for significant tax reforms that could alleviate financial burdens and stimulate economic growth. As discussions continue, it remains crucial for the government to recognize and address the needs of the middle class to ensure a more balanced and fair taxation system.