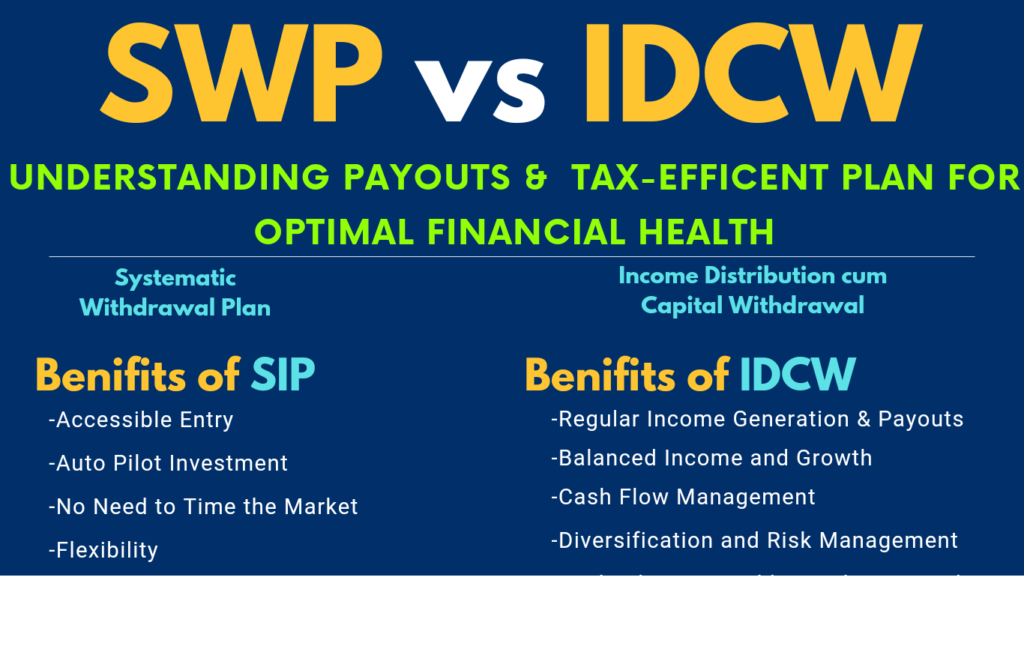

SWP vs IDCW – Understanding Payouts & Tax-Efficent Plan for Optimal Financial Health

A Systematic Withdrawal Plan (SWP) is a financial strategy that provides a steady income, enabling individuals to achieve life goals faster and compound their corpus. It is beneficial for retirees, regular income supplementers, and investors seeking to avoid higher taxes and compound investments simultaneously.

Benefits of IDCW-

IDCW offers a consistent dividend, similar to a paycheck from investments, with recurring distributions for ordinary costs, EMIs, or retirement planning. It balances income creation and capital appreciation, providing diversification and a consistent income stream. Investors can benefit from lower tax rates on dividends.

Benifits of SIP

An SWP (Systematic Withdrawal Plan) is a method that permits a corpus to compound over time while limiting the capital accessible for compounding. It is critical to carefully plan withdrawals, aiming for the “real rate of return” after accounting for inflation. For retirees, the longevity of their assets is a big concern.

For example, if a retiree has a Rs 1 crore corpus at age 60 and a life expectancy of 85 years, starting with a 6% monthly withdrawal and increasing annually, their corpus will last 26 years.

However, bigger drawdowns during the initial phase of investment can slow compounding time. To improve asset allocation, bucketing withdrawals and merging gig revenue might help the corpus last longer. To plan for emergency expenses, it is advised that

To plan for emergency needs, it is essential that you have numerous kinds of cash flow, such as gig revenue, rental income, and annuities. Insurance companies provide annuity rates ranging from 5.44% to 8.7%, depending on the plan. SWPs are popular among people looking for a consistent income stream, particularly during retirement, and can help manage cash flow needs without liquidating the entire investment.

Working with a financial advisor is recommended owing to individual goals and financial situations. Contact Us

Investcorpus.in-Your 360° Personal Financial Planner

Looking at Tax Enactment of SWP & IDCW

Depending on the length of time held and the amount withdrawn, SWPs may attract exit loads and capital gains. Withdrawals from SWPs are subject to capital gains tax; equity funds are subject to a 20% short-term capital gains (STCG) tax for holding durations under a year and a 12.5% long-term capital gains (LTCG) tax for holding periods over a year. Gains from debt funds are taxed in accordance with the income tax slab, but equity funds enjoy an LTCG of up to 1.25 lakh tax-free. Since long-term capital gains of up to 1.25 lakh are tax-free, selecting an SWP from equity-oriented funds is more tax-efficient. Prior to April 1, 2020, when investors took on the tax burden, dividends were widely accepted. SEBI modified the dividend nomenclature.

In order to highlight that payouts are based on the investor’s investment value, SEBI renamed dividends in April 2021 to (IDCW), which raised NAVs for growth options. Choosing an SWP would result in a higher tax of Rs 59,375 as opposed to Rs 1,87,200 for an IDCW payout option, and past performance is not a guarantee of future profits.

Benefits of IDCW:

• Regular Income Generation

IDCW provides a consistent dividend, similar to a paycheck from investments.

• Easy Cash Flow Management

IDCW provides investors with recurring distributions that can be utilized for ordinary costs, EMIs, or retirement planning.

• Balance income and resources growth

IDCW strikes a balance between income creation and capital appreciation.

• Better Risk Management

– The IDCW investor benefits from diversity and a consistent income stream.

• Tax Benefits

IDCW can profit from lower tax rates on dividends compared to capital gains.