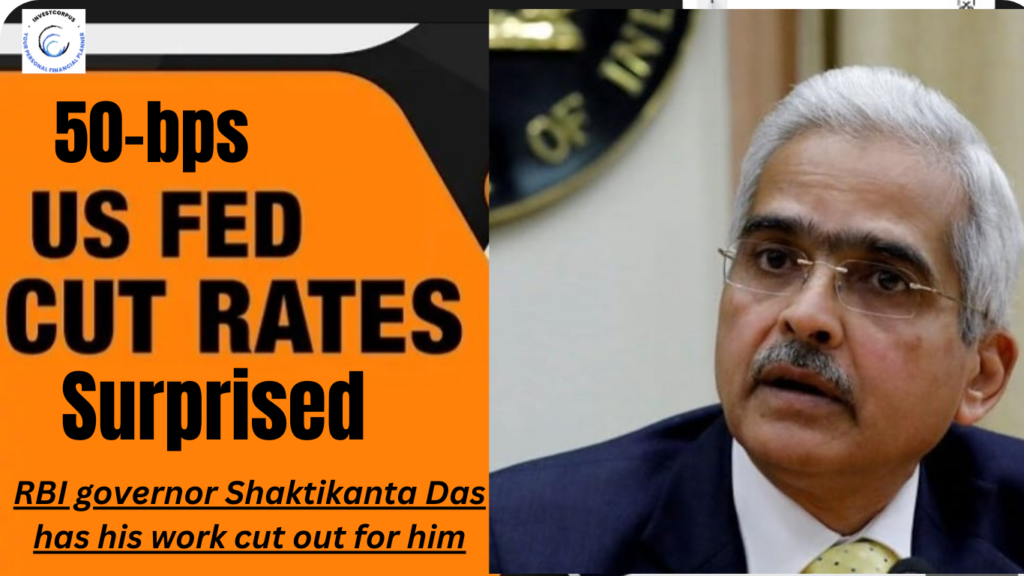

The Fed surprises everyone with a 50 basis point rate drop, thus RBI governor Shaktikanta Das has his work cut out for him

The worldwide cycle of interest rate easing presents unique challenges for the RBI. The emerging countries, including India, may see a rise in capital inflows if the global rate-cutting cycle quickens in the near future. This would provide additional difficulties for currency managers.

India may see an uptick in capital inflows if investors seek out higher returns in emerging economies and the global rate-cutting trend picks up speed.

Governor of the Reserve Bank of India Shaktikanta Das now faces a new set of issues as global central bankers enter a monetary policy easing cycle, following the US Federal Reserve’s unexpected 50 basis point rate decrease that sent shockwaves through the financial globe.

The RBI’s repo rate is 6.5%, while the Fed’s rate is currently somewhere between 4.75% and 5%. As inflation starts to decline, the European Central Bank (ECB) has already cut its short-term interest rate twice this year, most recently in September by 25 basis points. In addition, the Bank of Canada recently lowered its benchmark interest rate by 25 basis points, raising the possibility of further reductions soon.

Additionally, the Bank of England cut interest rates. Most likely, Other global central bankers are anticipated to join the interest rate easing cycle.

IN RBI’s Point of view : Regulating the expected strengthening of the rupee relative to the US dollar may put pressure on India’s exports, making the RBI’s delicate balancing act between promoting growth and reining in inflation more difficult.