Selecting a Tax Regime: Know how the New Tax Regime Can Help You Reduce Your Tax Burden

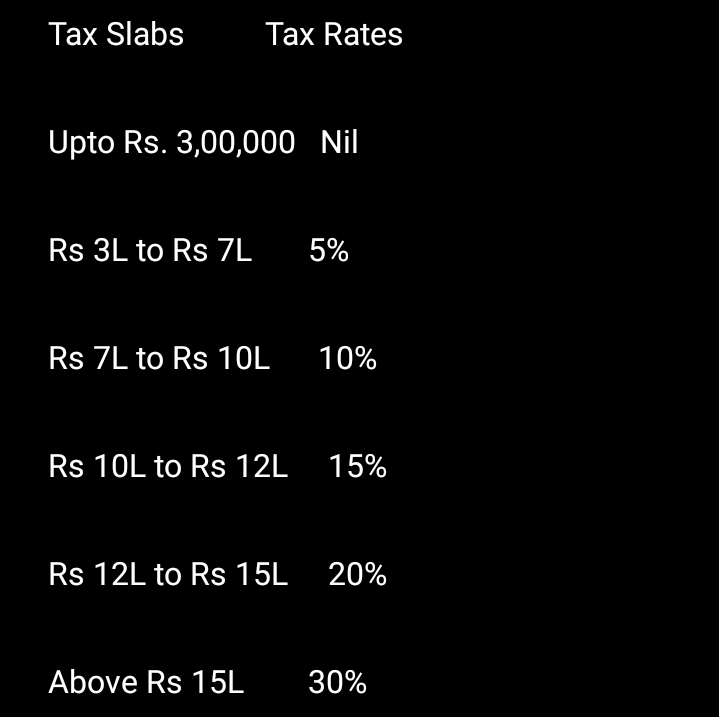

In the Indian Budget 2024, the Centre gov. introduced changes to the New Tax Regime for the next financial year, including an increase in the standard deduction by Rs 25,000 to Rs 75,000 and revisions to the tax slabs. However, the old tax regime was kept unchanged. Individual taxpayers can switch between the old and new tax regime on a year-on-year basis.

Under both tax regimes, the main objective is to cut tax outgo. Key strategies for taxpayers to reduce their tax burden under the new tax regime are as follows:

- Calculate the amount of tax they have to pay now.

- Choose between the old and new tax regime wisely.

- Avail the concessional tax rates.

- Use the concessional tax regime to reduce the overall tax burden, particularly for lower and middle-income groups.

- Increase the basic income exemption and concessional tax rates.

- Utilize the increase in the basic income exemption and concessional tax rates to optimize their tax liabilities.

- Availability of tax deductions and exemptions under the old tax regime.

- Use the new tax regime to claim certain specified deductions such as standard deduction on salary.

- Consider the impact of the new tax regime on income distribution.

How to calculate income tax on salary with example

The new tax regime in India allows certain deductions and exemptions, such as standard deductions on salary, reduced surcharge rates for taxpayers with total income above Rs. 5 crores, enhanced threshold limits for rebates under Section 87A, and long-term capital gains exemptions through reinvestment under Sections 54, 54F, or 54EC.

Taxpayers can switch between old and new tax regimes on a year-on-year basis, and those with income from business or profession can opt back to the old regime only once.

By strategically structuring their finances and leveraging the benefits available under Section 115BAC, taxpayers can optimize their tax liability under the concessional tax regime.

In conclusion, taxpayers can choose between the old and new tax regimes to reduce their tax burden. By analyzing available income and deductions, comparing tax payable under both regimes, and utilizing the concessional tax rates, taxpayers can optimize their tax liabilities and reduce their tax burden.

How much tax do i have to pay calculate now india.

Income tax calculator.

How to calculate income tax on salary with example.

Old vs new tax regime Calculator Excel.

Income tax Calculator old vs new.

Income tax calculator Excel.

Income tax Calculator new regime.

Income tax calculator income tax Department.