Hybrid funds are a strategic investment choice for 2025, as they can be a smart move in today’s complex financial landscape

Hybrid funds are gaining traction as a versatile investment option for 2025, helping investors balance growth and stability amidst financial uncertainties. By combining various asset classes such as equity, debt, and commodities, hybrid funds provide a strategic approach to risk management and consistent returns. This article explores the benefits, types, and current market context for hybrid funds, making a case for their inclusion in your investment portfolio.

Asset Allocation

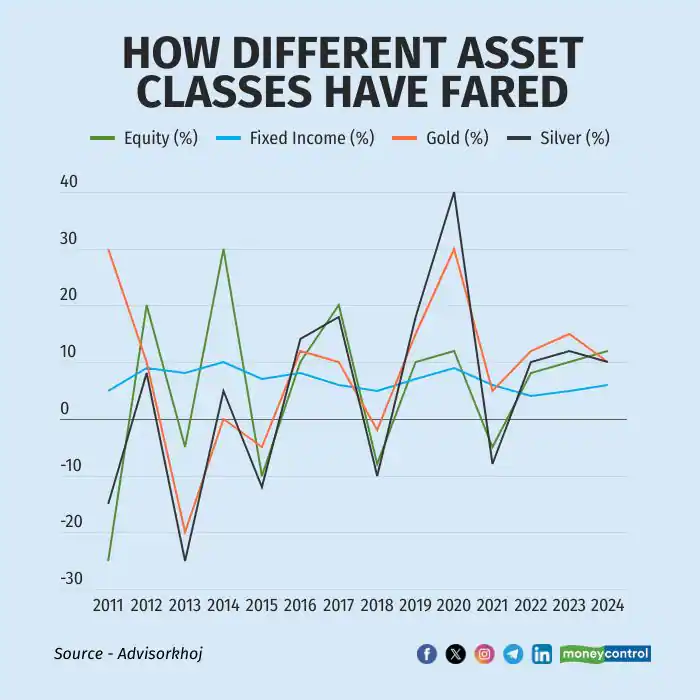

The principle of asset allocation is akin to a tightrope walker balancing their weight. A well-distributed investment portfolio can withstand market fluctuations better than one heavily weighted in a single asset class. Hybrid funds excel in this area by blending equities, debt, and commodities, ensuring that when one asset underperforms, another may compensate, thus smoothing out the investment journey.

Why Hybrid Funds Can Be a Perfect Fit

Hybrid funds are more than just a convenient option; they serve as shock absorbers in unpredictable markets. Their ability to cushion portfolios against volatility while still aiming for growth opportunities makes them attractive for various investors.

Types of Hybrid Funds

- Arbitrage Funds: These low-risk funds take advantage of price discrepancies in the market and are suitable for short-term goals.

- Conservative Hybrid Funds: Ideal for risk-averse investors, these funds typically allocate up to 25% in equities, providing a mix of stability and growth.

- Dynamic Asset Allocation Funds: These funds adjust their equity and debt exposure based on market conditions, minimizing risks during volatile times.

- Multi-Asset Funds: Investing in at least three asset classes, these funds offer consistent performance across different market environments.

- Aggressive Hybrid Funds: Targeted at risk-takers, these funds invest heavily in equities while maintaining some debt for volatility management.

Current Market Context

The Indian stock market has faced significant corrections in 2024, creating a unique opportunity for investors. With the Reserve Bank of India’s revised GDP growth outlook at 6.6% for FY 2025, coupled with moderating inflation and strong corporate fundamentals, the market appears poised for long-term growth. Hybrid funds, with their diversified portfolios, can provide stability amid short-term turbulence.

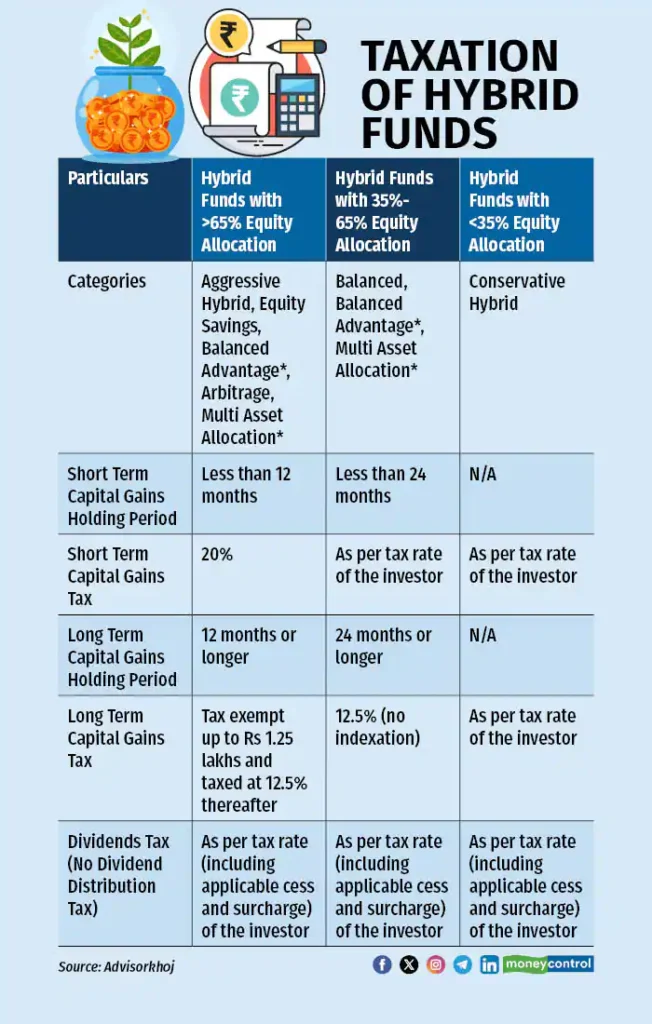

Tax Advantages

The 2024 Union Budget introduced changes to capital gains taxation, making hybrid funds a tax-efficient choice. Understanding the tax implications of these investments can significantly improve net returns, and consulting a financial advisor is recommended for clarity.

Final Takeaways

Hybrid funds represent a strategic investment choice for 2025, offering a blend of risk management and growth potential. They cater to various investor profiles—whether you prefer a conservative approach or a more aggressive strategy, there’s a hybrid fund suited to your needs. As market conditions continue to evolve, hybrid funds can serve as a steady guide, helping you navigate financial uncertainties while growing your wealth over time. Embracing hybrid funds could be a smart move in today’s complex financial landscape.