Financial Changes to Watch in February Budget 2025; Tax Relief, RBI Policy, UPI, Credit Card & Kotak.M Bank Changes

February 2025 brings significant financial updates impacting taxpayers, credit card users, and banking customers in India. Key changes stem from the Union Budget 2025, adjustments in credit card terms, updates to UPI regulations, and modifications to savings account rules. Understanding these changes is essential for effective money management.

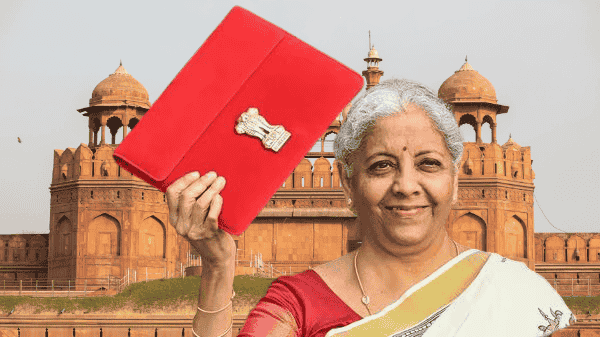

1. Union Budget 2025 Tax Relief

Finance Minister Nirmala Sitharaman announced a significant tax relief in the Union Budget 2025-26. The income tax exemption threshold has been raised from ₹7 lakh to ₹12 lakh. This means that individuals earning up to ₹12.75 lakh, factoring in a standard deduction of ₹75,000 for salaried individuals, will not have to pay income tax. However, it’s important to note that this exemption does not apply to capital gains, which are taxed separately based on short-term and long-term rates.

2. RBI Monetary Policy Meeting

The Reserve Bank of India (RBI) is set to hold its Monetary Policy Committee (MPC) meeting from February 5-7, 2025. The primary focus will be on reviewing the repo rate, with expectations leaning towards a potential rate cut. A reduction in the repo rate could lower loan equated monthly installments (EMIs) and influence deposit interest rates, making borrowing cheaper for consumers.

3. UPI Transaction ID Updates

Effective February 1, 2025, the National Payments Corporation of India (NPCI) has mandated that UPI transaction IDs must consist solely of alphanumeric characters. Transactions using special characters will be rejected. This change aims to standardize UPI payments and enhance transparency, ensuring safer and more efficient transaction processes.

4. IDFC FIRST Credit Card Changes

Starting February 20, 2025, IDFC FIRST credit cards will undergo several changes. Statement dates will be revised, and new fees will apply to education payments made through platforms like CRED and PayTM. Additionally, the card replacement fee will increase to ₹199 plus applicable taxes. Customers should also be aware of a new joining and annual fee of ₹499, which will be enforced post the implementation date.

5. Kotak Mahindra Bank 811 Account Changes

From February 1, 2025, Kotak Mahindra Bank will revise its charges for 811 savings accounts. A fee of ₹5 per ₹1,000 (with a minimum of ₹50) will apply to cash deposits exceeding ₹10,000 per month. Changes will also affect ATM withdrawal limits and fees for certain banking services. Notably, the standing instruction failure fee is reduced from ₹200 to ₹100, making it essential for customers to understand how these changes might impact their banking experience.

Important Details & Evidence

- The Union Budget 2025 offers significant tax relief, potentially benefiting a wide range of taxpayers.

- The RBI’s upcoming meeting could influence borrowing costs and savings interest rates.

- UPI updates reflect a move towards greater standardization in digital payments.

- IDFC FIRST credit card changes signal a shift in how fees are structured, affecting users’ financial planning.

- Kotak Mahindra Bank’s new rules highlight the need for customers to stay informed about their account conditions.

Final Takeaways

As February 2025 unfolds, it’s crucial for taxpayers and financial service users to familiarize themselves with these updates. The changes in tax regulations, banking fees, and payment systems will impact financial decisions and budgeting strategies. Staying informed through official channels will ensure that individuals can navigate these adjustments effectively and make the most of their financial resources.