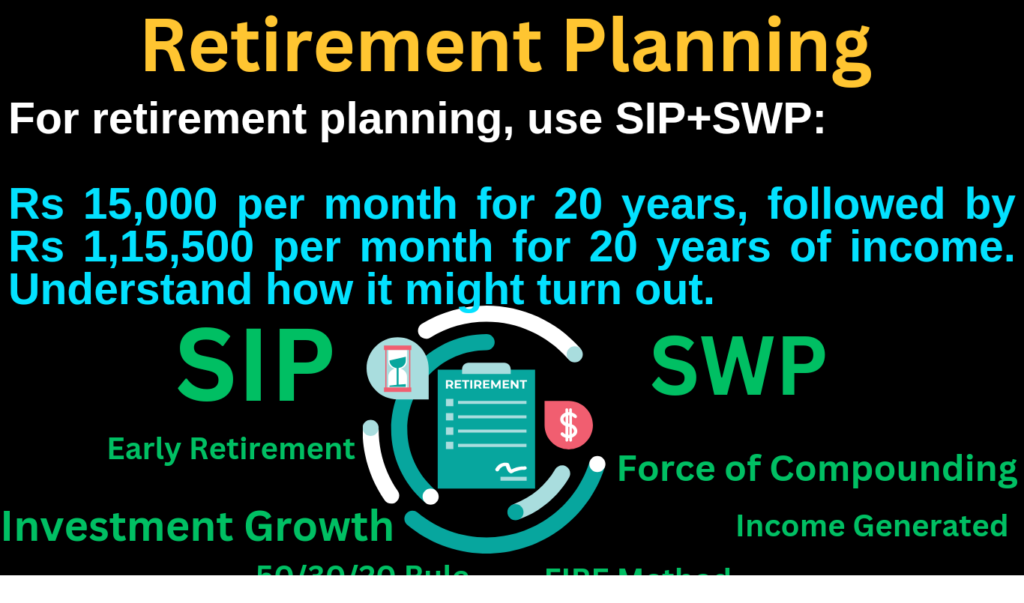

For retirement planning, use SIP+SWP: Rs 15,000 per month for 20 years, followed by Rs 1,15,500 per month for 20 years of income. Understand how it might turn out.

More advantages may result from combining a systematic withdrawal plan (SWP) with a systematic investment plan (SIP). One can receive consistent income for years to meet their needs by making regular SIP investments and SWP withdrawals.

Two crucial investments for efficient retirement planning are the Systematic Investment Plan (SIP) for Investment Growth and the Systematic Withdrawal Plan (SWP) for using income results from profit came out of investment.

Through disciplined investing and the force of compounding, SIP enables people to invest small, regular sums in mutual funds that gradually help them accumulate a retirement corpus.

Conversely, SWP permits people to take money out of their investments when they retire. It maintains the capital for future need while generating a consistent income.

Read Also: SWP Vs SIP Which is Better for You? Recognize the Difference Between SIP for Growth & SWP for Income