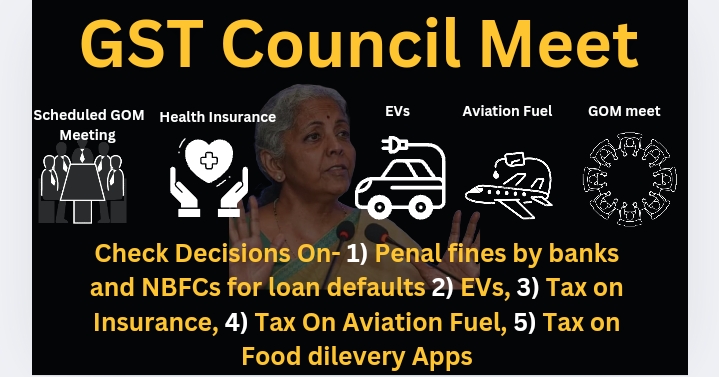

GST Council Meet: Check decisions On- 1) Penal fines by banks and NBFCs for loan defaults 2) EVs, 3) Tax on Insurance, 4) Tax On Aviation Fuel, 5) Tax on Food Apps

The GST Council reduced the compensation cess rate for merchant exporters to 0.1%, reduced tax on fortified rice kernels to 5%, extended exemption for missile parts, and clarified popcorn taxation. The 55th GST council meeting also exempted indirect tax for payment aggregators under Rs 2000, and announced no GST on penal charges.

List of Key outcomes of 55th GST – Finance Minister council meet:

- GST Council cuts tariff on fortified rice kernels to 5%.

- Gene therapy is now exempt from GST.

- GST The council recommends an adjustment to the definition of pre-packaged and labeled items.

- Exemption granted for the Long Range Surface to Air Missile (LR-SAM) system.

- No GST will be due on penal costs assessed against borrowers by banks or financial institutions.

- GST – FM Council meet defers decision to reduce tax on insurance premiums as numerous inputs

- CESS compensation rate is reduced to 0.1% for supplies to merchants.

- ACC blocks with more than 50% fly ash will attract 12 percent.

- GST on Black pepper( kaali mirchi) , whether fresh or green and raisins supplied by an agriculturist are not subject to GST.

Tax on Aviation Industry Fuel

No decision has been taken on health insurance or the ATF, as states have not felt comfortable with it.

Tax on Electric Vehicles Industry

The GST Council in India aims to promote electric vehicles (EVs) by imposing a 5% GST on new EVs, with an 18% tax levied on used EVs and resale transactions. The 18% GST will also apply to the margin value between the purchase price and selling price of a used car.

Tax on Popcorn 🍿

The tax treatment of popcorn has been clarified, with pre-packaged and labelled ready-to-eat popcorn attracting a 12% GST, while caramelized popcorn (mixed with sugar) will be taxed at 18%