GST reduction on life and health insurance: How much will your insurance premium likely decrease in the near future?

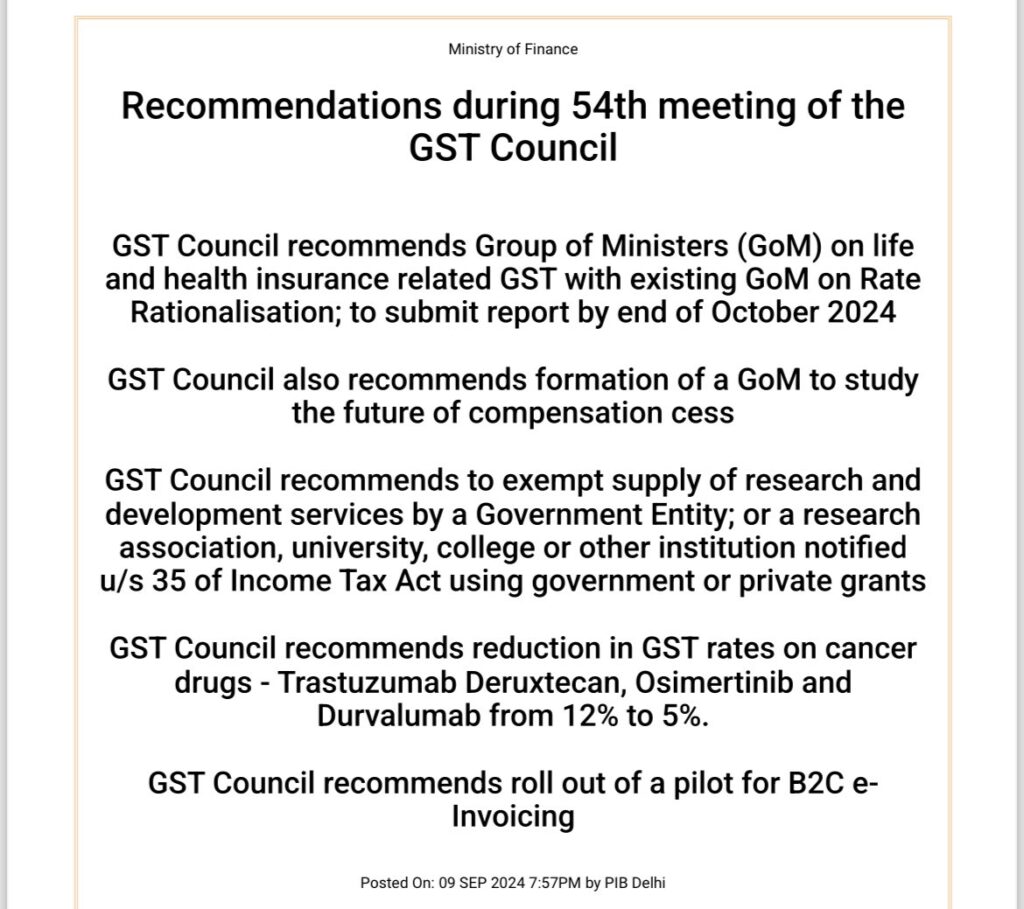

A group of ministers (GoM) tasked by the Goods and Services Tax (GST) Council to oversee rate rationalisation, is considering lowering the tax on life and health insurance premiums. This potential reduction could offer financial relief to individuals and families purchasing insurances. The GoM is expected to submit its report to the GST Council by October 31, and the final decision will be made by the GST council. Could GST on insurance premiums be reduced to zero?

Read Also:Group of Ministers (GoM) will examine the health insurance GST issue

GST rate reduction: How is it going to impact your insurance?

Assume you have health insurance and pay a premium of Rs 10,000. Currently, the GST rate on your health insurance premium is 18%. Therefore, you pay Rs 1,800 in GST for each health insurance premium. Thus, Rs 11,800 is the total cost of the health insurance premium (Rs 10,000 + Rs 1,800). You are no longer need to pay the extra GST amount for each health insurance premium if the GST has been eliminated. You would have to pay Rs 1,200 in GST on a Rs 10,000 health insurance premium if the GST rate was lowered from 18% to 12%. The total cost of your health insurance will be Rs 11,200 (Rs 10,000 + Rs 1,200). Consequently, you will save Rs 600 (between Rs 11,800 and Rs 11,200) on each premium.

You can save Rs 1,800 on each health insurance premium if the GST is lowered to zero.

Read Also:General insurance sector gets Rs 18,000 crore GST bonanza

Would it be possible to eliminate GST on insurance premiums?

By October 31, 2024, the GoM is supposed to deliver its report to the GST Council. The committee will then decide on a final course of action.