IRDA Released: Annual Report of Life Insurance and Health Insurance Claim Settlement Ratio for 2025

The Insurance Regulatory and Development Authority of India (IRDA) released the latest Claim Settlement Ratio for Life and Health Insurance on December 23, 2024. Here we provide an in-depth look at the meaning of the Claim Settlement Ratio, its implications, and key insights from the IRDA Annual Report for 2024. The analysis emphasizes the limitations of using the Claim Settlement Ratio as the sole criterion for evaluating insurance companies.

Insights from the IRDA Annual Report 2024

The report highlights significant statistics, including unclaimed amounts in life insurance, changes in insurance penetration and density, and grievance statistics.

- Lack of Detailed Information: The CSR does not specify the types of products settled (e.g., Endowment plans, ULIPs, Term Insurance Plans).

- Unclear Rejection Reasons: The data does not explain why certain claims were rejected, making it difficult for consumers to assess a company’s reliability fully.

- No Individual Company Data: Since IRDA has ceased publishing individual company ratios, consumers must exercise caution when evaluating claims made by insurance companies regarding their CSR.

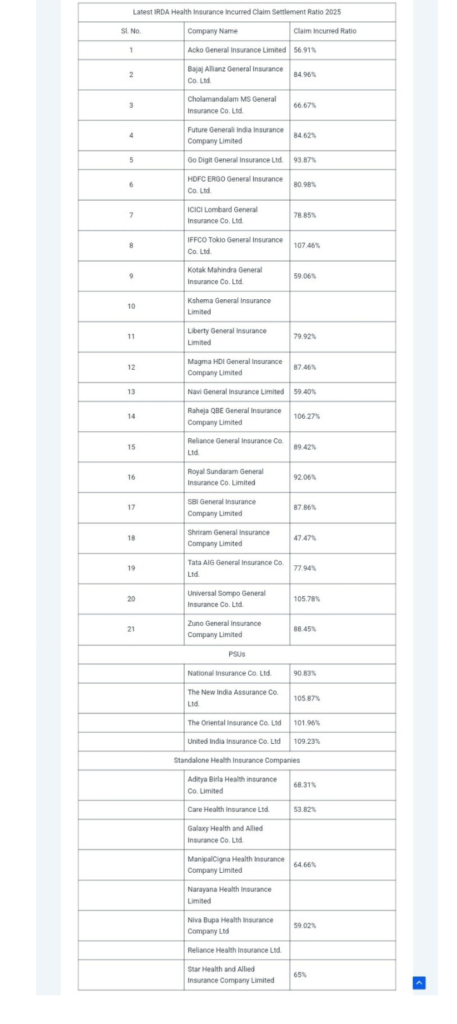

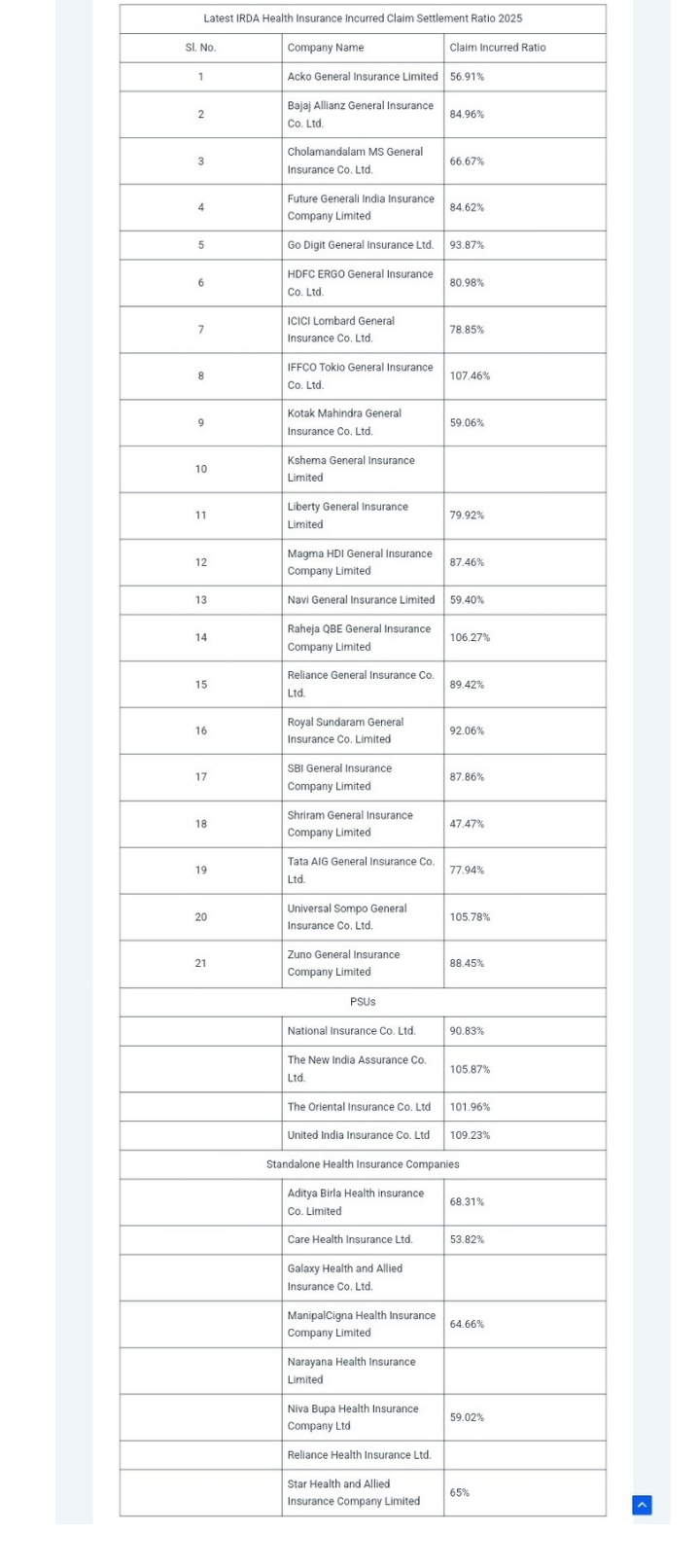

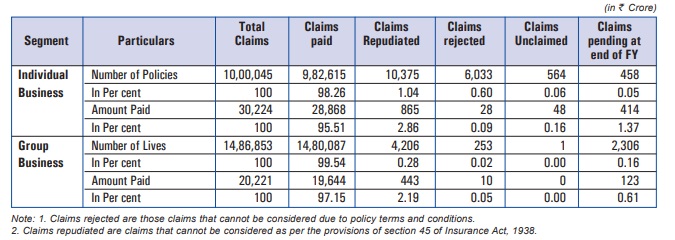

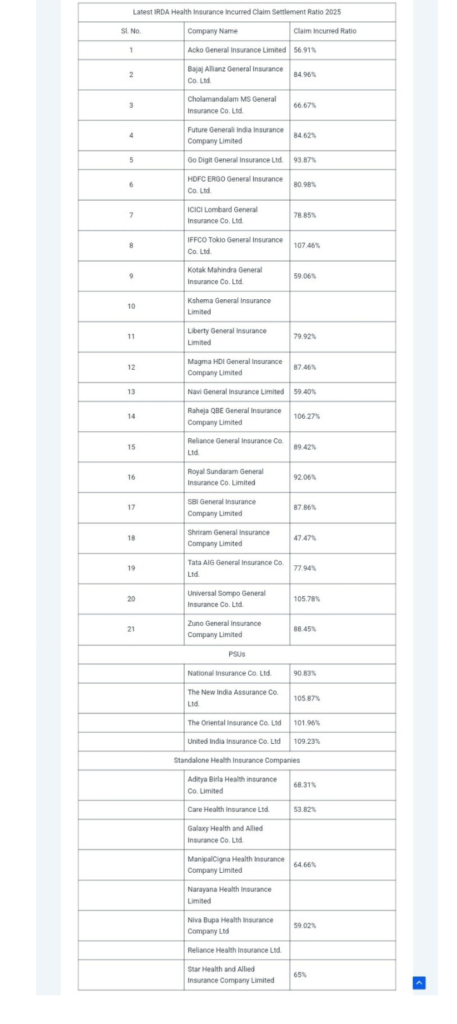

3. Health Insurance Incurred Claim Ratio

In health insurance, the Incurred Claim Ratio (ICR) serves a similar purpose to the CSR. The ICR is calculated as follows:

Incurred Claim Ratio (ICR) =

{(Total Value of Claims Paid) / (Total Premiums Collected)} ×100

For instance, if a company pays claims worth ₹90 Crore against ₹100 Crore in premiums, its ICR would be 90%. This metric is crucial for evaluating the financial health of health insurance providers.

4. Conclusion on Evaluation Criteria

The IRDA data suggests that relying solely on the Claim Settlement Ratio can be misleading when assessing insurance companies. Consumers are encouraged to consider various factors, including:

- Policy Features: Evaluate the specific benefits and coverage offered by different insurance products.

- Premium Affordability: Ensure that premiums are within budget while providing adequate coverage.

- Company Reputation: Research the company’s history, customer service, and transparency.

- Disclosure Practices: Ensure all necessary information is disclosed to avoid potential claim rejections in the future.

Final Takeaways

The latest IRDA Life and Health Insurance Claim Settlement Ratio 2025 provides valuable insights but should not be the sole factor in determining the quality of an insurance company. Consumers must assess a range of criteria, including product offerings, premium costs, and the company’s overall reputation, to make informed decisions regarding life and health insurance. The evolving landscape of insurance metrics emphasizes the need for a comprehensive evaluation approach, ensuring consumers select policies that best meet their needs while minimizing the risk of claim rejections.

- Unclaimed Amounts: At the start of FY 2023-24, the total unclaimed amounts by life insurers stood at ₹22,237 Crore.

- Insurance Penetration: India’s insurance penetration dropped from 4% to 3.7% of GDP, indicating a decrease in the proportion of the economy dedicated to insurance premiums.

- Insurance Density: Conversely, insurance density, which measures the average expenditure on insurance per person, increased from USD 92 to USD 95.

- Distribution Channels: For LIC, 96% of new business comes through agents, while in the private sector, 51% originates from corporate agents such as banks. In health insurance, individual agents contribute 30%, brokers 29%, and direct sales 28%.

- Grievance Statistics: A total of 215,569 grievances were reported on the Bima Bharosa portal, with 120,726 related to life insurance and 94,843 to general insurance. Death claims constituted 5% of grievances, while survival claims made up 19.95%.

Consumers are advised to consider multiple factors beyond the Claim Settlement Ratio when evaluating insurance companies.

Key Points

- Definition of Claim Settlement Ratio: This ratio indicates the percentage of death claims settled by a life insurance company within a financial year.

- Limitations of the Ratio: The Claim Settlement Ratio does not provide a complete picture of an insurance company’s performance, as it lacks details about the types of claims settled and reasons for claim rejections.

- Health Insurance Incurred Claim Ratio: The Health Insurance sector utilizes the Incurred Claim Ratio (ICR) to measure claims settled against premiums collected, differing from the Claim Settlement Ratio used in life insurance.

Detailed Breakdown

1. Understanding the Claim Settlement Ratio

The Claim Settlement Ratio (CSR) is a critical metric that reflects how effectively a life insurance company handles death claims. It is calculated using the formula:

Incurred Claim Ratio or ICR=(Total Value of Claims Paid/Total Premiums collected)×100.

For example, if a company receives 100 claims and settles 98, its CSR would be 98%. A high CSR suggests that a company is customer-friendly in settling claims; however, it does not provide insight into the nature of the policies involved or the reasons behind any claim rejections.

For example, if a company receives 100 claims and settles 98, its CSR would be 98%. A high CSR suggests that a company is customer-friendly in settling claims; however, it does not provide insight into the nature of the policies involved or the reasons behind any claim rejections.

2. Limitations of the Claim Settlement Ratio

While the CSR is a useful indicator, it has several limitations:

- Lack of Detailed Information: The CSR does not specify the types of products settled (e.g., Endowment plans, ULIPs, Term Insurance Plans).

- Unclear Rejection Reasons: The data does not explain why certain claims were rejected, making it difficult for consumers to assess a company’s reliability fully.

- No Individual Company Data: Since IRDA has ceased publishing individual company ratios, consumers must exercise caution when evaluating claims made by insurance companies regarding their CSR.

3. Health Insurance Incurred Claim Ratio

In health insurance, the Incurred Claim Ratio (ICR) serves a similar purpose to the CSR. The ICR is calculated as follows:

Incurred Claim Ratio (ICR) =

{(Total Value of Claims Paid) / (Total Premiums Collected)} ×100

For instance, if a company pays claims worth ₹90 Crore against ₹100 Crore in premiums, its ICR would be 90%. This metric is crucial for evaluating the financial health of health insurance providers.

4. Conclusion on Evaluation Criteria

The IRDA data suggests that relying solely on the Claim Settlement Ratio can be misleading when assessing insurance companies. Consumers are encouraged to consider various factors, including:

- Policy Features: Evaluate the specific benefits and coverage offered by different insurance products.

- Premium Affordability: Ensure that premiums are within budget while providing adequate coverage.

- Company Reputation: Research the company’s history, customer service, and transparency.

- Disclosure Practices: Ensure all necessary information is disclosed to avoid potential claim rejections in the future.

Final Takeaways

The latest IRDA Life and Health Insurance Claim Settlement Ratio 2025 provides valuable insights but should not be the sole factor in determining the quality of an insurance company. Consumers must assess a range of criteria, including product offerings, premium costs, and the company’s overall reputation, to make informed decisions regarding life and health insurance. The evolving landscape of insurance metrics emphasizes the need for a comprehensive evaluation approach, ensuring consumers select policies that best meet their needs while minimizing the risk of claim rejections.